SAN FRANCISCO – October 15, 2024 – Snapdocs, the mortgage industry’s leading digital closing provider, today announced plans to automate every critical interaction between lending and settlement teams throughout the mortgage closing process. The company will introduce new AI-powered capabilities within its platform that streamline complex closing tasks to increase customer efficiency and improve the borrower experience. These advancements inspire the company’s new brand identity.

“Mortgage closings are expensive, error prone, and time-intensive due to the fragmentation of the multiple people, processes, and technologies involved. Unsurprisingly, a recent survey showed 60% of homebuyers experience frustration during this final, critical step of the mortgage process.1 Lending and settlement teams are at the center of this challenge, burdened with manual coordination and stare-and-compare tasks. We are on a mission to automate these critical interactions to make the closing stress-free for mortgage professionals and a celebratory experience for borrowers.”

— Michael Sachdev, CEO of Snapdocs

Expanded Digital Closing Technology for Lenders & Title Companies

Today, Snapdocs powers 1-in-4 mortgage transactions with its digital closing platform. This includes an eClosing solution that digitizes all loans and closing types, an eVault for the secure storage and transmission of eNotes, and Notary Connect, a market-leading notary scheduling solution. This technology, paired with Snapdocs’ extensive settlement and notary networks and white-glove customer service, maximizes digital adoption. Snapdocs lender customers achieve digital closing adoption at 3X the industry average and eNote adoption at 2X the industry average.2

Digital closings go beyond the signing event—and Snapdocs believes that every complex interaction before, during, and after the eSignature should be digitized to accelerate timelines, reduce errors, and enhance the borrower experience. Guided by this belief, Snapdocs is developing new functionality to address additional time-consuming, manual, and error-prone interactions. These new capabilities include:

- CD Balancing: Automatically compares Closing Disclosures (CDs), surfaces fee differences, streamlines secure lender and settlement communication, and pushes correct fee amounts to the lender's system of record.

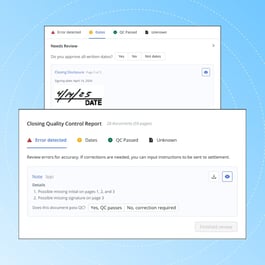

- Funding Quality Control: Instantly and accurately performs quality control for critical-to-fund documents. Proprietary AI models confirm each page is present, signed, dated, and stamped correctly so lenders can confidently release funding to their borrowers in minutes.

- Post-Close Quality Control: Virtually eliminates manual indexing and post-close file review, ensuring the full, executed package is complete and accurate according to the lender's QC checklist.

- Trailing Document Management: Accelerates final document delivery by eliminating manual follow ups with settlement, automating document pushback to the LOS, and uses proprietary AI models to confirm all documents are accurate and have been received.

A New Brand Identity for Snapdocs

Snapdocs also launched a new brand identity, supporting the company’s growth and expanded product functionality. The new look reflects Snapdocs’ mission to automate the home mortgage experience by connecting the people, processes, and technologies that power the industry.

“Our new visual identity embodies our focus on connecting the mortgage industry and simplifying the closing experience for both borrowers and the teams serving them. We continue to embrace the color orange—symbolizing optimism, warmth, and confidence—while our updated logo represents our innovative, integrated solutions that encourage seamless collaboration for all mortgage participants.”

— Kat Benenati, VP of Product and Marketing at Snapdocs

Snapdocs’ expanded platform and new brand mark a significant milestone in the company’s journey, solidifying digital closings as an essential solution in the mortgage industry and its commitment to make mortgage a snap. For more details on the Snapdocs rebrand, read the full story here.

1 Research conducted through a third-party research platform and included responses from 2,042 individual responses who financed a home purchase with a mortgage in the U.S. between January 2022 and June 2024. The Borrower Experience Report, 2024.

2 Data derived from total loan volume transacted on the Snapdocs platform from January 2023 to July 2024, alongside research conducted by Arizent on the top 100 mortgage lenders.

About Snapdocs

Snapdocs is the leading digital closing provider, connecting the people, processes, and technologies that power a mortgage closing. Our platform automates every interaction between lenders and title companies from pre-closing through the sale of the loan. With our patented AI technology, hands-on customer service, and extensive settlement and notary networks, all mortgage participants enjoy accurate, smooth, and secure closings. This approach gives customers a competitive advantage by saving them time and money. Snapdocs makes mortgage a snap. For more information, please visit www.snapdocs.com.

Media Contacts

Sam Garcia, Publicist

Strategic Vantage Marketing and Public Relations

214.762.4457 | samgarcia@strategicvantage.com

For Snapdocs

Laura Mighdoll, Business Contact

Snapdocs

press@snapdocs.com