Lock down your eNotes.

Unlock seamless transfers.

The secure way to digitally store, maintain, and transfer digitized documents.

Increase security. Improve efficiency.

Scale eNotes across your entire loan portfolio with the only eVault designed for lenders, by lenders. Maintain the security of every promissory note and ensure fast delivery to secondary market partners.

The Snapdocs difference

Custom-built for the mortgage industry

Snapdocs worked with lenders and secondary market participants to design, test, and build an eVault for the unique needs of mortgage transactions.

Partnership in change management

Seamlessly transition to eNotes with guidance from industry experts, allowing you to implement quickly and confidently.

Designed for scale

Achieve your eNote scaling goals by partnering with the leader in digital closing adoption.

Position your business for long-term success

Snapdocs eVault is essential for ensuring the safety and security of your promissory notes, while improving operational efficiency.

The only eVault made for mortgage

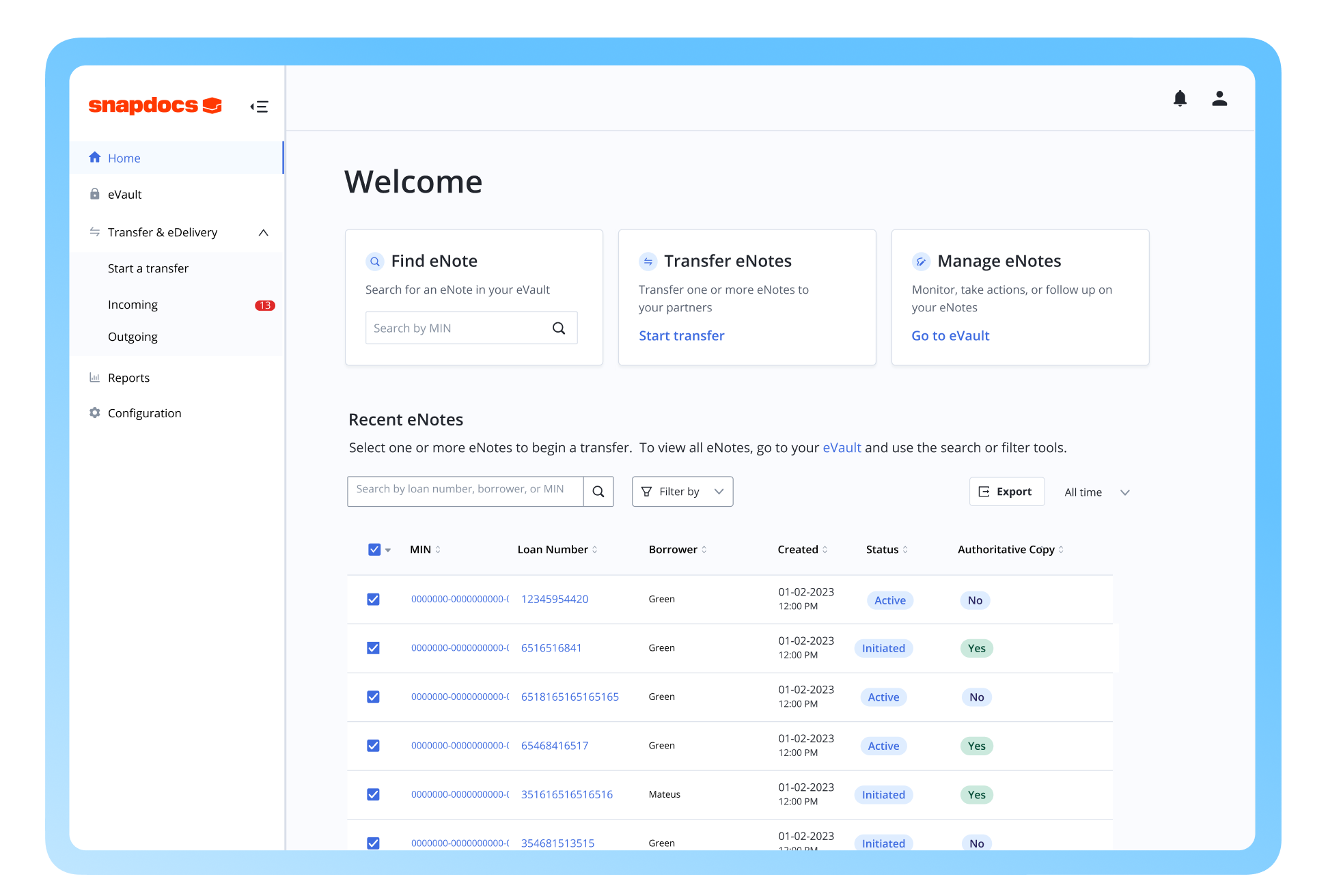

Ease of use

- Works for all loan types

- Enables bulk transfers

- Distinguishes between authoritative and non-authoritative eNote copies

Best-in-class security

- Custom reporting and comprehensive audit logs

- Application of tamper-seal after each borrower signing

- Additional third-party security testing and validation

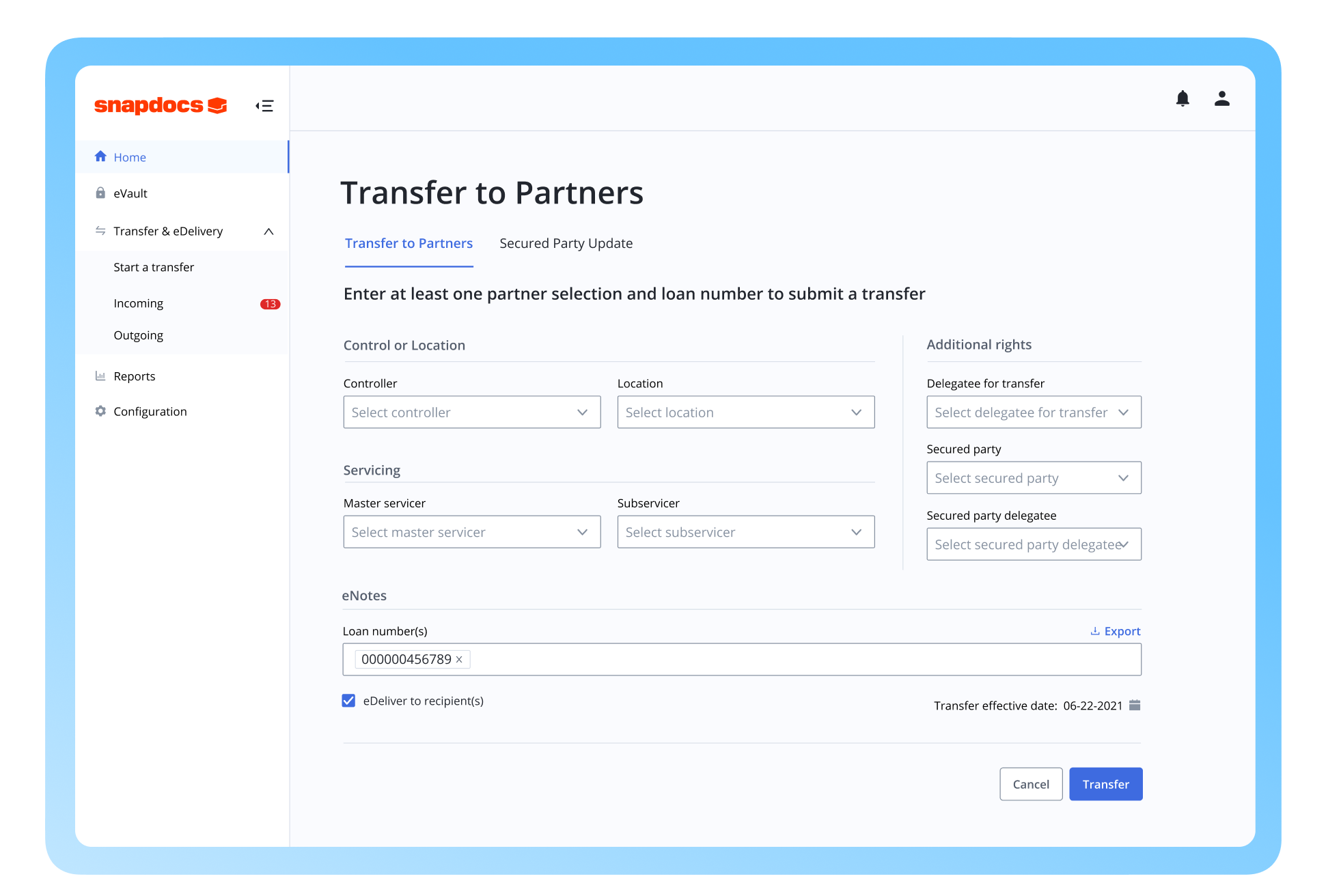

Fully interoperable

- Compliant with MERS®, MISMO®, and GSEs

- Transfer eNotes to any other eVault partner

- Fully integrated with Snapdocs eClose

Everybody wins when you go digital

Key Results

- 80% hybrid adoption

- 100K+ eNotes transacted in 5 years

- 5 min closing appointments

We wanted to scale eNotes because it impacts efficiency in post-closing and delivery and so many other areas of our business.”

– Teri Pansing, SVP Corporate Closing

Approved by

.png?width=250&height=136&name=MISMO-eVault-Seal%20(1).png)

MISMO® Certified eVault Provider

Snapdocs is the first eVault provider to achieve compliance with MISMO® standards.

eVault resources

Trailing Document Management

Preferred Rate Eliminates Manual File Reviews with ...

Zions Reduces Errors by 80% with Snapdocs Funding Quality ...

Unlocking Efficiency: How to Automate Quality Control ...

PRMI Achieves eNote Adoption 3x Industry Average with ...

Checklist: Talking to Investors About Digital Closing

Here are the 2025 Tech100 Mortgage Honorees

The Definitive Guide to Digital Closings, 2025 Edition

The MISMO logo is a registered trademark and the MISMO mark is a trademark of the Mortgage Industry Standards Maintenance Organization, Inc. Snapdocs is a MISMO Certified Product and meets the compliance requirements for eClosing, RON, and eVault certifications as further described in the MISMO Standards and Program Materials on mismo.org.