This article is part of our educational series on the five key factors that determine how digital your mortgage closings can be, known as e-Eligibility.

For more information, download the full eBook or get your free e-Eligibility assessment to determine how digitized each loan in your portfolio can be.

Digitizing mortgage closings is a complex process. In addition to the challenges of operationalizing a centuries-old system, lenders need to be aware of the factors that impact the extent to which a mortgage can be closed digitally. We call these factors the 5 R’s of e-Eligibility. In this article, we’ll cover title underwriter restrictions, one of the factors of e-Eligibility.

Restrictions refers to whether the title underwriter imposes any restrictions on digital mortgage closings. Title underwriters might have their own policies related to digital mortgage closings, but they are primarily concerned with the use of eNotarization. For example, title underwriters could impose more stringent eNotarization requirements than those of permissible via other e-Eligibility factors as a means to mitigate risk.

By understanding the title underwriter’s restrictions ahead of time, lenders can ensure that the digitization path they take is appropriate. Importantly, lenders can save time and avoid the cost of churn from having to redo their digitization work after discovering the title underwriter restrictions later in the process.

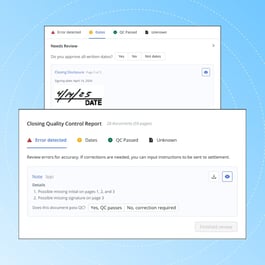

The chart below gives lenders a detailed framework for what to consider when assessing title underwriter restrictions.

Title Underwriter Restrictions at a Glance

Definition of Title Underwriter Restrictions:

- Whether the title underwriter imposes any restrictions on digital mortgage closings

Primary Stakeholders:

- Title underwriter, settlement agent

Objects:

- Closing protection letter

Systems:

- Title production systems, proprietary title underwriter systems

Mortgage Cycle:

- Pre-Closing

Decision Power:

- Weak–The title underwriter, while performing a service that benefits the lender and ultimately the investor, is contracted through settlement for its services. Further, aside from refinance transactions, the borrower typically selects the settlement agent.

Boons:

- ++ The title underwriter accepts all forms of digital mortgage closings where legally permissible without further limitations unique to digital mortgage closings

- + The title underwriter accepts certain forms of digital mortgage closings, with limitations

Drags:

- The title underwriter imposes significant restrictions on digital mortgage closings beyond what is legally permissible

- The title underwriter imposes some restrictions on digital mortgage closings

Sources of Variability:

- Loan amount, loan type, document type, property type, borrower type, eNotarization type, eNotarization platform

Process:

- Title underwriters provide settlement agents with guidelines they must follow

Considerations:

- With respect to digital mortgage closings, title underwriter requirements are primarily associated with the use of eNotarization. They may impose more stringent limits than those legally permissible to mitigate risk. For example, title underwriters might require that the eNotarization be performed on a platform that has been reviewed and approved by the title underwriter. Or, they might require the use of an in-state notary for a RON transaction even if not expressly required by law.

- Lenders that successfully implement digital mortgage closings see improved operational efficiency. If you’re ready to scale your digitization, we’ve created a framework to help you track the numerous challenges and factors to consider. Download our eBook, The 5 Rs of e-Eligibility for Mortgage Closings, to learn more.

To explore the other five factors of e-Eligibility, check out these articles:

- Why Lenders are Digitizing Mortgage Closings Today

- Six Obstacles to Addressing e-Eligibility when Digitizing Mortgage Closings

- The Five Rs of e-Eligibility when Digitizing Mortgage Closings

- The Five R’s of e-Eligibility when Digitizing Mortgage Closings: Requirements

- The Five R’s of e-Eligibility when Digitizing Mortgage Closings: Recording