Last year, we announced plans to expand the Snapdocs platform to automate the critical interactions between lending and settlement teams throughout the mortgage closing process. One solution we developed to address these time-consuming, manual, and error-prone interactions is Trailing Document Management—built to reduce workload and accelerate final document delivery for lenders with in-house final document teams.

The challenge: a tedious, time-intensive process

Managing trailing documents, including the recorded mortgage, recorded riders, and final title policy, is a tedious, manual process for many lenders. Final document teams spend hours following up with settlement partners and tracking status updates in the LOS. Once received, these teams need to manually quality control, scan, and process the final documents back into the LOS—demanding significant time, effort, and communication between parties.

Seamless final document management

Snapdocs’ Trailing Document Management addresses these challenges by enabling lenders to track, manage, and receive final documents within the Snapdocs eClosing platform. This functionality reduces manual workload, accelerates final document delivery, and keeps all parties apprised of the status of these documents. As a result, lenders can confidently ensure that the necessary documents are completed and received in a timely manner, allowing lenders to transfer trailing documents to the end investor on time.

.

Specifically, Trailing Document Management:

- Reduces manual follow-ups to title agents: With automated reminders to settlement agents, even after the closing process is complete, Snapdocs reduces the burden for lending teams and ensures documents are received promptly.

- Saves time processing documents: Lenders no longer need to manually input final documents into their systems. Snapdocs automatically pushes digital copies of trailing documents back to the LOS, driving down processing time and reducing bottlenecks in the post-closing process.

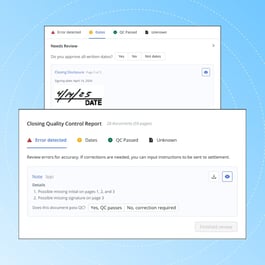

- Decreases risk and ensures loan sellability: Our proprietary AI performs quality control (QC) on scanned documents to ensure the recorded mortgage, riders, and final title policy were uploaded—eliminating the risk of human error and creating loan files ready for the secondary market.

- Optimizes internal team resources: Final document teams can leverage a central dashboard to understand which files are outstanding, enabling employees to focus exclusively on late trailing documents and other higher value tasks.

- Strengthens settlement agent adoption: By managing trailing documents in the same platform used for closing coordination, Snapdocs makes it easier for title partners to quickly upload and track documents.

“Snapdocs’ Trailing Document Management solution makes our lives a lot easier,” says Paul Smyth, Senior Loan Delivery Manager at Waterstone Mortgage.“It provides one platform for both us and our title partners to manage trailing documents. Now 98%+ of documents uploaded by settlement are the accurate trailing documents. Those then get scanned directly into our LOS which reduces our manual work and is a huge benefit.”

Technology built to optimize more of the mortgage closing process

Snapdocs Trailing Document Management represents another step in our journey to digitize the complex closing interactions before, during, and after eSignature—accelerating timelines, reducing errors, and enhancing the closing experience for all parties. By automating these manual tasks, lenders can allocate resources more effectively and scale efficiently in fluctuating market conditions.

Interested in learning how Trailing Document Management can save your team time? Get in touch with our team.