EBOOK

Remote Online Notarization (RON) 101:

What to Know About the Technology Enabling Remote Digital Mortgage Closings

This guide is for leading lenders seeking to seize the future of mortgage closings using eNotarization technology.

Overview

The future of mortgage closings is remote. And that future is now, owing to wide-ranging acceptance of RON by counterparties and investors, as well as improved clarity around technology requirements from MISMO. RON is faster than in-person mortgage closings, offering a better experience for the borrower and higher efficiency for the lender.

What’s inside:

- Notarization in a Digital World: Learn about the various pathways for eNotarizing mortgage closings

- How RON Works: Navigate the regulatory and legal landscape that determines the e-Eligibility of your loan portfolio

- Benefits of RON: Build a business case for RON by better understanding key benefits lenders realize by adopting the technology

- Getting Started with RON: Take the first steps towards gaining stakeholder buy-in and planning implementation in lending and settlement operations

Additional RON resources

eBooks Guides and More

Download Now

The State of eClose Adoption in 2025

Press Release

Read More

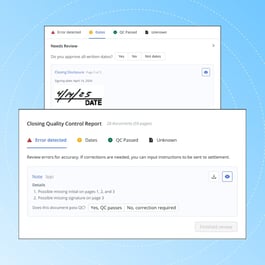

Snapdocs Introduces AI-Powered Quality Control to Improve ...

Case Study

Read More

Preferred Rate Eliminates Manual File Reviews with ...

Case Study

Watch Now

Zions Reduces Errors by 80% with Snapdocs Funding Quality ...

Webinars

Watch the Replay

Unlocking Efficiency: How to Automate Quality Control ...

Press Release

Read More

Snapdocs Becomes First eVault Provider to Achieve MISMO® ...

Case Study

Watch Now

PRMI Achieves eNote Adoption 3x Industry Average with ...

Awards

See More