RON Integrations

Let borrowers close from anywhere with Remote Online Notarization (RON)

Turn convenience into your competitive advantage. Give borrowers a fast, convenient, and completely digital, mortgage closing experience.

Give your team the most effective RON solution

One efficient process for every closing

Maximize closer and settlement efficiency with a single process for every loan type including wet, hybrid, hybrid + eNote, and RON.

A practical path to RON adoption

Snapdocs helps lenders build successful eClosing strategies. We maximize adoption—starting with hybrid closings and using a phased approach to implement eNote & RON.

Easily source a remote notary in the correct state

Tap into the industry’s largest network of 140k+ qualified notaries for RON, mobile, & attorney closings.

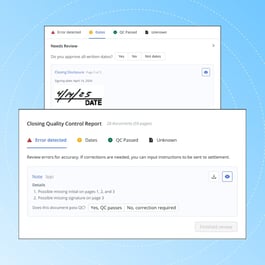

AI automatically prepares all documents for eSignature

Snapdocs AI automatically tags lender and title documents for eSignature, eliminating manual tasks for you and your partners.

Flexibility to choose the right notary

Flexible notary configurations allow you to choose the right notary for any circumstance, including options to assign settlement as the notary, auto-assign your favorite notaries, or rely on Snapdocs to source a quality notary on your behalf.

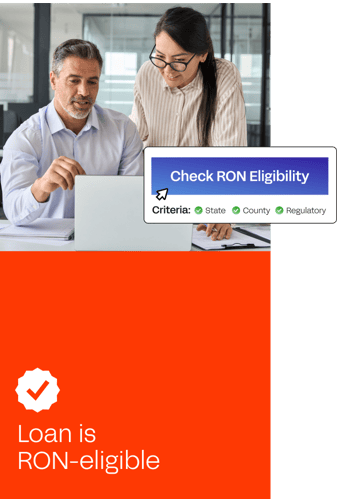

Check RON eligibility automatically, without leaving your LOS

Easily check that a loan is RON-eligible and eliminate the need for manual, time-consuming tasks. With one click, Snapdocs checks your loan's characteristics against RON criteria—including up-to-date state, county, and regulatory requirements.

Snapdocs makes it easy to offer RON eClosings in locations and with investors where RON is accepted.

Snapdocs is a MISMO-certified RON provider

Key Results

- 70% hybrid closings

- 40% more loans closed with the same number of closers

- 60% faster closings

- 80% reduction in errors

We have worked our way through hybrid closing, hybrid with eNote, and now full eClose with Remote Online Notarization. There are many lenders, many much larger than us, who have not even started their eClosing project. We are thrilled to provide this improved experience for our customers and the title companies we work with in the loan closing process.”

– Tom Knapp, CIO

Additional RON resources

The State of eClose Adoption in 2025

Snapdocs Introduces AI-Powered Quality Control to Improve ...

Preferred Rate Eliminates Manual File Reviews with ...

Zions Reduces Errors by 80% with Snapdocs Funding Quality ...

Unlocking Efficiency: How to Automate Quality Control ...

Snapdocs Becomes First eVault Provider to Achieve MISMO® ...

PRMI Achieves eNote Adoption 3x Industry Average with ...