The industry’s leading closing software has partnered with the industry’s leading origination software to bring lenders the most powerful mortgage closing solution on the market.

San Francisco, CA; March 4, 2020 — Snapdocs, Inc. , the mortgage industry’s leading digital closing solution, announced today a new integration partnership that makes its digital closing platform available through the Ellie Mae Digital Lending Platform. This exciting partnership creates an origination-to-closing table and back again connection, seamlessly unifying lenders, title, signing agents and borrowers in a single workflow for every closing. In addition to its game-changing platform, Snapdocs simplifies the closing process by offering a comprehensive suite of closing tools, including borrower document preview, automated hybrid document sorting and annotating, eSignature, eNote and more. This marks a significant turning point for an industry that has been anxiously awaiting a solution that can bridge the gap between the many participants in the mortgage close and enable digital closings at scale. By transforming fragmented processes, Snapdocs empowers lenders and settlement to realize powerful efficiencies while delivering review-worthy customer experiences.

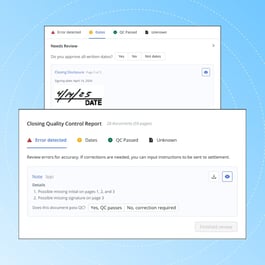

Snapdocs already offers what no other mortgage closing solution can: an existing network of more than 50,000 mortgage professionals, proprietary artificial intelligence, a track record of success at scale and a modern platform that delivers a beautiful experience for everyone involved. Currently powering over 13% of U.S. residential mortgage transactions, Snapdocs provides lenders and settlement with the tools to streamline their internal operations and adopt digital mortgage closings at scale. With Snapdocs, lenders have been able to digitize 99% of their loans in an average of four months, reduce errors that get surfaced at the closing table by 80% and reduce their borrower’s closing appointment to 15 minutes. All of this results in a shorter closing process, removing on average two or more days in lender dwell time.

“We’re proud to partner with Ellie Mae to help lenders thrive in the digital age,” said Aaron King, CEO and founder of Snapdocs. “The closing process is complicated and involves coordinating multiple parties and documents. By digitizing the closing with Snapdocs, lenders are cutting days off their funding time, eliminating errors and giving their borrowers the simple digital closing experience they expect and deserve.”

“We are thrilled to partner with Snapdocs to provide added value to Ellie Mae customers,” said Parvesh Sahi, senior vice president, business development, Ellie Mae. “Through this integration, our customers will be able to adopt digital mortgage closings to reduce time to close and offer a more efficient, seamless experience.”

Ellie Mae is a leading provider of innovative on-demand software solutions and services for the residential mortgage industry. Ellie Mae empowers lenders and investors to engage homebuyers and efficiently originate, close, sell and purchase loans that maximize ROI across their business all from a single system of record. The platform delivers a true digital mortgage experience across the entire mortgage workflow for every channel, every loan transaction and every customer type.

About Snapdocs

Founded in 2013, Snapdocs is the industry’s leading digital closing platform. With its patented AI technology and connected platform, Snapdocs is on a mission to perfect mortgage closings for all. Powering over one million closings a year, Snapdocs is leading the charge to modernize, streamline, and improve the mortgage process for lenders, borrowers, and settlement. Snapdocs is the only solution with a proven track record of creating a single, scalable process for every closing. Every day, over 50,000 mortgage professionals rely on Snapdocs’ technology to automate manual work and digitize paper processes that plague the industry. Snapdocs is a rapidly growing San Francisco based real estate technology company backed by Silicon Valley blue-chip venture capital funds, like Y Combinator, SV Angel, Founders Fund, Sequoia Capital, and F-Prime Capital. To learn more, please visit snapdocs.com.