DATASHEET

About Snapdocs

Learn how we automate the critical interactions between lending and settlement teams to accelerate closing timelines, reduce errors, and enhance the borrower experience.

$500 savings per loan

8 days faster to close and ship

80% + fewer errors

+10 pts. increase in borrower NPS

3x higher eClosing adoption

Learn about the platform that supports 1 in 4 U.S. mortgage transactions

CD Balancing

The faster, more accurate way to balance Closing Disclosures

eClosing

Efficient, error-free digital closings at scale

Notary Connect

Connect to the nation’s largest notary network

eVault

Securely store, maintain, and transfer eNotes

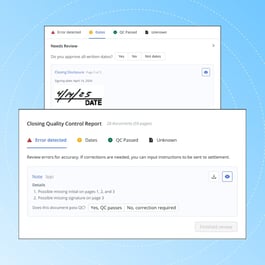

Quality Control

Eliminate errors and accelerate funding

Trailing Document Management

Reduce workload and accelerate doc delivery

Additional eClosing resources

Press Release

Read More

Snapdocs Study Finds 90% of Lenders Offer Digital ...

eBooks Guides and More

Download Now

The State of eClose Adoption in 2025

Webinars

Register Now

Mortgage Industry Insights: The 2025 State of eClose ...

Case Study

Watch Now

eClose Adoption: Real Stories of Scaling from Snapdocs ...

Case Study

Read More

AnnieMac Saves 35+ Minutes Per Loan Using Snapdocs ...

Blog

Read More

Trailing Document Management

Press Release

Read More

Snapdocs Introduces AI-Powered Quality Control to Improve ...

Case Study

Read More