Notary Connect results

97%

positive consumer review rating

1.3

average notary assignment time (minutes)

4.8/5

average notary rating

About

Founded in 2008, Vantage Point Title is a National Title, Escrow and Default Services Provider with “one point of contact”. At its core, Vantage Point delivers superlative customer experiences by offering cutting-edge technology, consistency in process and price, and a unique, centralized services approach. Vantage Point offers products that assist in the entire Loan Closing process from title insurance products to property reports, tax verification, full title curative, as well as complete closing/settlement and Escrow services in all 50 states.

Challenge

Vantage Point Title (Vantage Point) saw a spike in transactions–as many title companies did–throughout 2020. In January of 2021, Vantage Point decided to implement Snapdocs Notary Connect to increase operational efficiency. Key areas that needed to be improved: customer experience, greater efficiency via increased transactions per scheduler, and cost savings. Vantage Point also needed a way to publish the documents to the notary and track when the notary is reporting completed signings.

Solution

With Snapdocs, Vantage Point has been able to schedule more orders in less time while consistently delivering increased customer satisfaction. With lower costs, holistically better customer experiences, and faster turn times Vantage Point has broken away from the competition in the eyes of customers – as evidenced by maintaining a very strong 97% positive Consumer Review Rating while seeing an increase in transactions.

“The biggest benefit of using Snapdocs as a title company is the ability to get funding corrections back faster, track closings, and have copies of documents back to us within hours.”

— David Silcott, President

Vantage Point realized that it is nearly impossible to provide the best customer experience while manually scheduling signing appointments. Toward the end of 2020, Vantage Point Title realized their need for a transparent and efficient signing experience that is easy to use while minimizing time-consuming tasks such as scheduling closings and uploading documents. Through Snapdocs, Vantage Point has also been able to decrease time-to-fund loans which represents a key metric for their largest, strategic lender customers.

In 2021, Vantage Point had over 8,000-10,000 orders a month–50-70% of which they’d have to schedule manually. Now, Vantage Point has automated their scheduling process and only schedules 17% of their orders manually. With high-efficiency scheduling, customers have given Vantage Point at 97% positive Consumer Review Rating–proving no drop in satisfaction from the automations put into place when orders spiked.

“We’ve seen enormous efficiency gains from Snapdocs during a busy year, yet no drop in customer satisfaction. That alone should say something.”

— David Silcott, President at Vantage Point Title

Title companies like Vantage Point excel when they are ahead of the market and see significant improvements during busy times. From H1-H2 of 2021, Vantage Point saw a 180% volume increase and expects an additional 4,000+ volume increase in 2022: “We’ve seen enormous efficiency gains from Snapdocs during a busy year, yet no drop in customer satisfaction. That alone should say something,” shares Silcott.

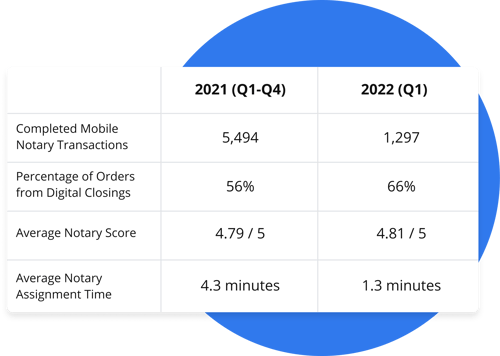

Median notary assignment time is 3.3X faster, from 4.3 minutes to 1.3 minutes YoY from March 2021-March 2022, while the notary median auto-assignment rate improved from 58% to 83%. The notary median auto-assign rate is where a notary is automatically assigned without the user–in this instance a Vantage Point escrow officer–needing to log into Snapdocs. The positive correlation between auto assign time and notary assign time remains strong–resulting in 97% positive reviews from 115,000 total.

“At Vantage Point Title, it’s important to provide the best customer experience to keep people coming back to us. Snapdocs is giving us a way to reduce costs, increase transactions per scheduler, and improve our customer experience. That’s a win-win.”

David Silcott, President at Vantage Point Title

Integrations are key for Vantage Point. Throughout 2020-2021, Vantage Point invested in their technology stack which improved their overall workflow in anticipation of transaction spikes. With a critical ResWare integration in place, Vantage Point is able to continue business like before, but only now better: “We didn’t have to halt business or change our workflow to fit Snapdocs’ requirements. Our key partners integrated directly with Snapdocs creating a seamless transition to a more efficient process for our team and our customers,” says Silcott.

As Vantage Point grows, they plan to service more customers in the 50 states they are already in. And, as mortgage demand fluctuates due to the real estate market, Silcott knows his team will be prepared: “We know the demand varies depending on the year, but we know we can now provide a simple and fantastic experience for our customers no matter what. Having that peace-of-mind no matter the state of the market is priceless for us."

Additional Notary Connect resources

The State of eClose Adoption in 2025

Snapdocs eClosing Demo at NYMBA Tech Day

The Definitive Guide to Digital Closings, 2025 Edition

Economist Roundtable: 2025 Mortgage Predictions

Who is Snapdocs?

Snapdocs Platform Overview

Snapdocs Expands Digital Closing Platform & Unveils New ...