Snapdocs Quality Control

Confidently automate your file review process and deliver high-quality loans, faster.

Say goodbye to stare-and-compare

99%

accuracy in catching errors

$140

savings per loan

99%

reduction in pages reviewed

1.5

hours saved per loan

Accelerate funding and enhance accuracy with AI-powered Quality Control—designed to eliminate errors, reduce review times, and save you money.

In today’s fast-paced lending environment, manual file reviews waste valuable time. Teams spend hours checking each individual page. Avoidable mistakes—like missing pages, signatures, or wrong dates—can lead to costly re-executions and damage a lender’s reputation. Even worse, these errors can render a loan unsellable.

Snapdocs Quality Control offers a smarter, faster solution.

“The time savings with Snapdocs’ Post-Close QC have been remarkable. What once took over 45 minutes per loan is now complete in under 10 minutes—with more accuracy and consistency. This efficiency has not only improved our throughput but has also empowered our post-close team to focus on strategic initiatives instead of drowning in manual work.”Stephanie Zinsmeister, EVP of Operations

“Funding QC is a game-changer. We no longer have to comb through every document manually, and focus only on the minor exceptions. The system instantly alerts both us and the settlement agent if an error pops up. Then it’s resolved within a minute. We’ve seen a 50% drop in re-records and the whole process is faster, easier, and more secure.”Chris Lekousis, VP of Operations

Snapdocs Quality Control

One seamless solution—uniquely designed for each part of the review process.

Funding Quality Control

Instantly verify that every critical-to-fund document is present and accurate.

AI-powered reviews

Automatically check critical-to-fund documents for missing pages, signatures, dates, initials, and notary stamps

Instant QC report

Get detailed results in under 2 minutes—so your team only needs to focus on exceptions

Catch errors before selling the loan

Avoid re-execution costs by relying on highly accurate AI models

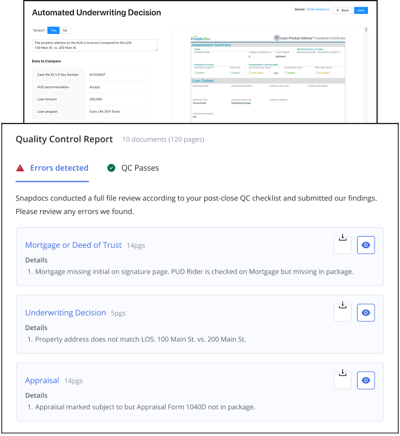

Post-Close Quality Control

Ensure that closing and origination documents are accurate after execution.

Data accuracy check

Verifies that every page displays accurate loan details, including property address and loan amount

AI & human reviewers

Intelligent algorithms, backed by expert validation, quickly review and confirm all lender, title, and origination docs are present and executed

Enhanced file indexing

Automatically index documents into eFolders based on your preferences

Customer Story

Zions Reduces Errors by 80% with Snapdocs Funding Quality Control

Increased accuracy, automation, and speed—hear how Zions achieved 75%+ hybrid adoption in one month and now saves 20 minutes of quality control (QC) time per file with the Snapdocs platform.

Ready to transform your file review process?

Discover how Snapdocs Quality Control can help your team deliver high-quality loans, faster and more efficiently than ever.