SNAPDOCS SPRINT

The Fast-track to Digitizing Mortgage Closings

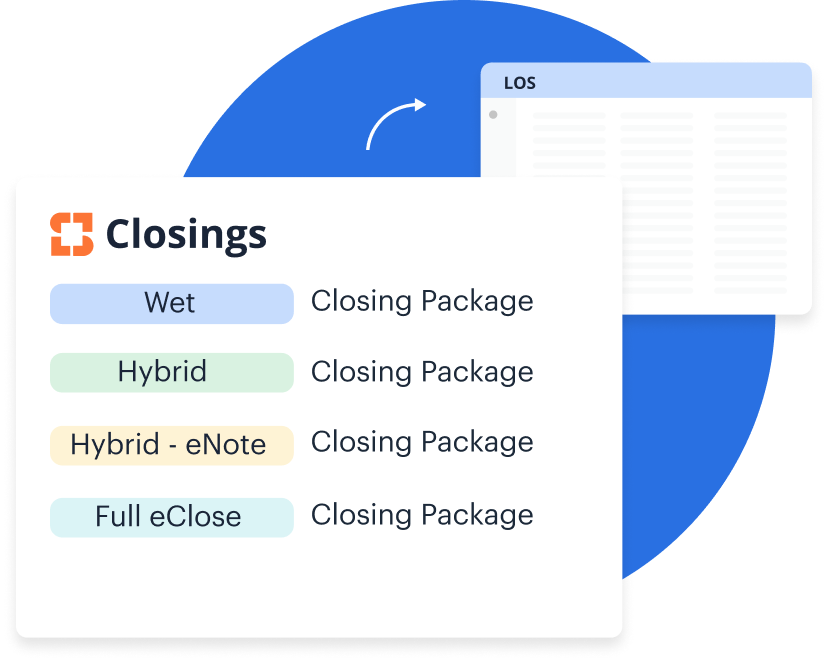

Need to accelerate your closings? Our Snapdocs Sprint program is geared to get you going fast. Wet, hybrid, and eClose.

Get Your eClosings Off The Starting Blocks

On average, Snapdocs’ clients implement in two months and digitize 100% of their closings in five. Having implemented digital closing programs for leading mortgage lenders, we know what it takes to start fast.

So we started Snapdocs Sprint: a costless service for lenders who are racing to digitize closings.

How it works

-

We (almost) instantly integrate with your LOS, POS and DocPrep system; then we train Snapdocs’ AI to automatically digitize your loan packages and train your staff and settlement partners on how to use the system.

-

Begin processing loans wet, hybrid, eClose, or any combination thereof. Start with a small trial or your whole loan volume.

-

Once you’re up and running, we’ll help you make the move to a 100% eClosings with remote online notarization (RON).

Tom Knapp | CIO of Waterstone Mortgage

“We’re already seeing Snapdocs and our ‘hybrid as default’ offering become a competitive advantage. It’s still a nice surprise for some once they’ve chosen Waterstone Mortgage as their partner, but borrowers now seek us out because of it.”

WHY SNAPDOCS

Our eClosing experts

Our Fast Implementation Team

Get support from an implementation specialist, running alongside you every step of the way. They know what it takes to keep up the pace. And they watch for roadblocks, too: LOS/Doc Prep/POS integration issues, settlement adoption, and other potholes can slacken any sprint. We’re here to fast-track your eClose effort.

Minimize Disruptions by Processing Any Closing Type

Start fast using a single platform to manage all closings. With Snapdocs, you can have one process for every closing with every partner, start-to-finish.

Jan Valencia | Residential Mortgage Systems Project Manager at KS StateBank

“When we first started looking at eClosing capabilities, I realized that it was a bigger need for the whole digital solution, where it wasn’t just about eSigning, but it was also about the workflow around that.”

The Future of Mortgage Closings

Once you’re up and running, we’ll help you make the move to 100% eClosings with remote online notarization (RON). It’s a marathon: We start first by executing hybrid closings across all your branches. Then, we set up your eNote and eVault and help you complete the MERS process. Finally, you’re ready to offer RON to your borrowers.

The #1 rated integration with Encompass

Unlock a single platform for eClosings, hybrid closings, and wet closings.

Don’t wait. Get our

Snapdocs Sprint service today.

Whether for a trial run or for your whole loan volume, Snapdocs Sprint will get you up-to-speed on our eClosing solution. And with The Snapdocs Guarantee, we promise your satisfaction with each transaction or we’ll cover the cost. Taken together, we make it easy to “get off to the races” with eClosings.