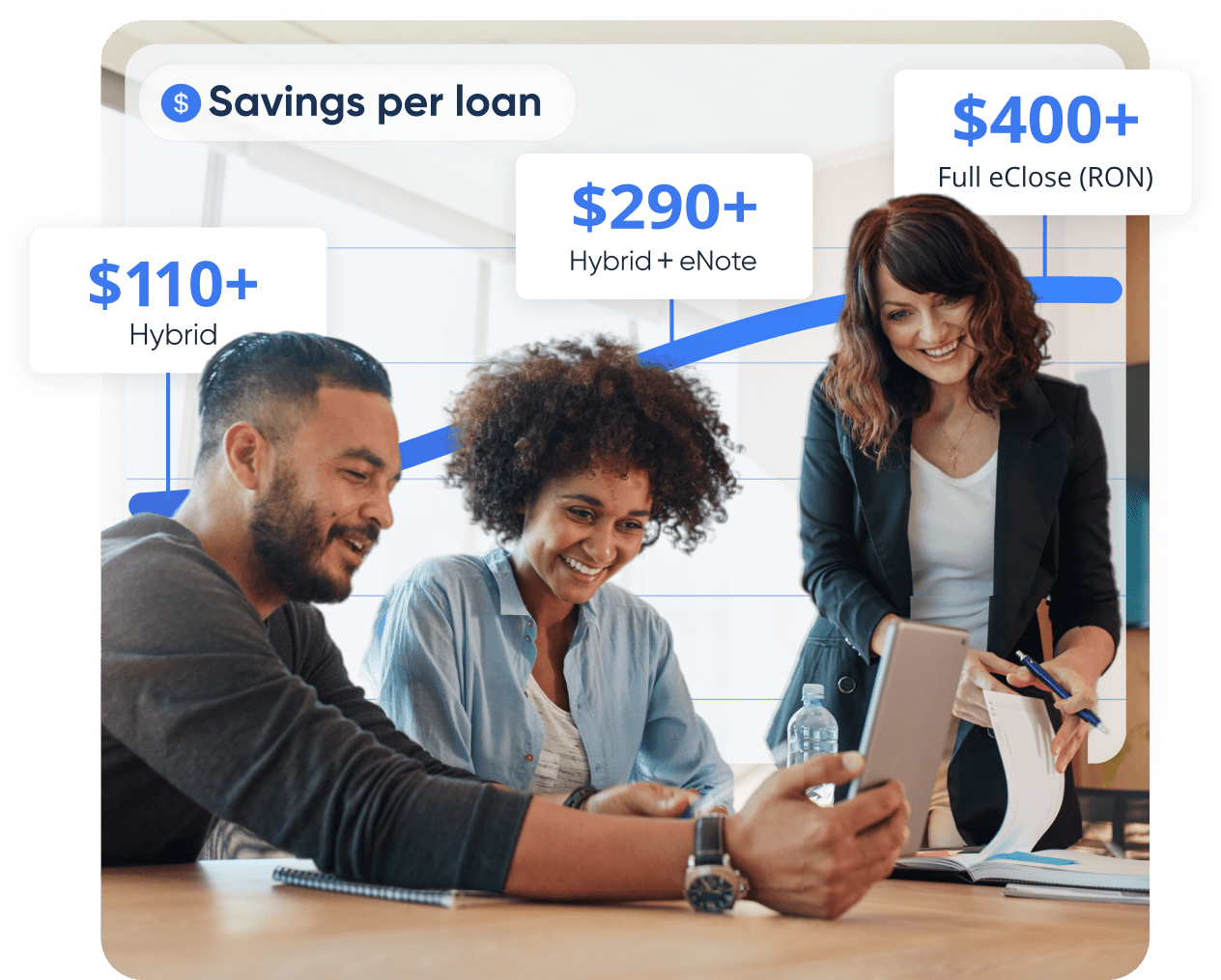

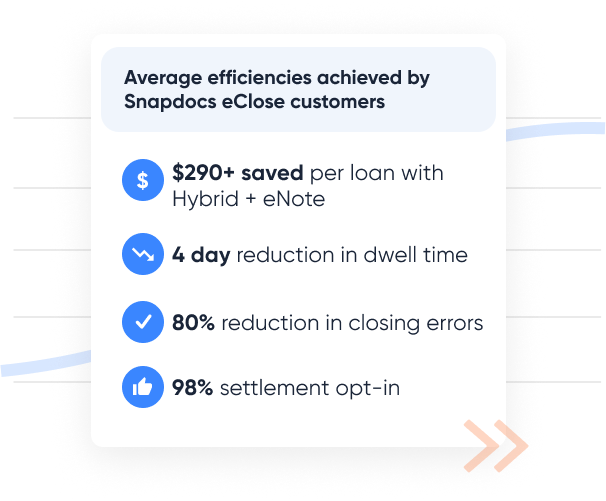

Save hundreds per loan with the mortgage industry’s #1 eClosing platform

Explore the power of cost-savings, efficiency, and unmatched borrower experience with Snapdocs eClose solution.

Trusted by

Praise for the Snapdocs eClosing Solution

Learn why market-leading lenders choose Snapdocs to transform the mortgage process.

"When looking for a partner, Snapdocs stood out to me because they know what they're doing—digital closings is what they do. Plus, Snapdocs being tech agnostic sets us up for many years of success in the future."

– Dave Williams, CIO / CISO, Gold Star Financial

“Switching to the Snapdocs eVault was a smooth and seamless process. We have more transparency into the status of each transaction, it’s user friendly, and easy to navigate.”

– Alyssa North, Senior Vice President of Operations at Primary Residential Mortgage, Inc.

“We firmly believe that Snapdocs is the optimal partner to help us accomplish our goals. The Snapdocs platform enables a more efficient closing process, provides better service to our valued customers, and positions us for future growth.”

– Kevin English, COO, New American Funding

Seamlessly connect to your LOS, POS, and more, thanks to open APIs and integrations that work with your current tech stack.

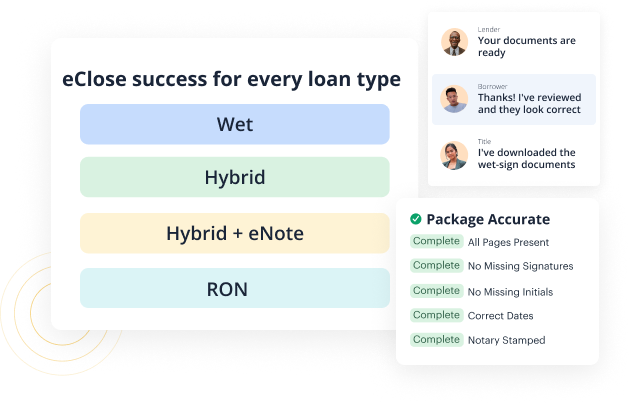

Enjoy one streamlined process for every closing type, loan type, and edge case.

Experience AI-powered document processing that immediately prepares docs for eSignature and automatically checks for errors on executed packages.

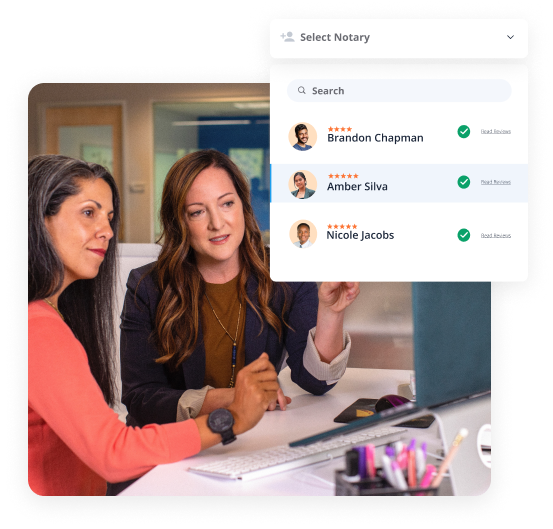

Ensure adoption of your eClose initiative by tapping into the industry's largest network of settlement agents, settlement offices, and qualified notaries.

Access the hand-in-hand support and partnership that has earned Snapdocs multiple industry awards.

Experience the Snapdocs eVault, your key to unlocking eNote at scale

Explore the highly-anticipated Snapdocs eVault, backed by award-winning eClose technology, mortgage industry guidance, and the custom support necessary to achieve your eNote goals.

Integrations & Partners

It takes more than just great technology to achieve best-in-class eClosings

The key to the perfect mortgage transaction lies in connecting the people, processes, and technologies that power our industry. Explore our integrations and industry partnerships to see how Snapdocs streamlines your transition to digital closings—no matter who you work with.

Connecting the industry through digital closing solutions

Select your organization type to learn how Snapdocs can help you save time and money on every transaction.

Connecting the industry through digital closing solutions

Select your organization type to learn how Snapdocs can help you save time and money on every transaction.

Lender

Simplify the mortgage process for every closing with a powerful pair of products: our award-winning eClose platform and best-in-class eVault.

Learn moreTitle & Escrow

Accelerate every mortgage closing and connect instantly with over 140,000 notary signing agents & attorneys for mobile & RON eClosings.

Learn moreSigning Service

Instantly source, vet, schedule, and pay for a qualified notary anywhere in the country.

Learn moreNotary Signing Agent

Access over 250,000 mobile and RON loan signing opportunities each month, gain exposure to 100+ hiring companies, and efficiently manage your business online.

Learn more

Take control of the closing process with fast, convenient, and error-free eClosings

Browse our eClose Solutions

#1 Digital Mortgage Closing Software Verified by Customers

The Snapdocs eClosing platform is the highest rated in our category by customer reviews on G2. This ranks Snapdocs as the Highest Performer, Highest Performer Americas, and Easiest Admin.

Browse our library of eClosing resources

Get started with eClosings today

Delight your borrowers with a secure, transparent, and efficient digital closing platform for every loan type.