ARCHIVE

2021 eClosing Product Release Notes

January 5, 2021 Product Release

New Features

Closings

Closings

- Consumers

- We're launching a newly improved "Review and eSign" user experience for Consumers. Here are some highlights:

- Simplified User Interface to help the Consumer quickly navigate and complete the review & eSigning regardless of which device they are using at the moment to do so.

- Provide info of the next step, whether it's eSign next or when will eSigning be available.

- Lastly, a fun confirmation screen to celebrate your success in eSigning all documents! Complete with virtual confetti, because who doesn't like confetti, right?

- We're launching a newly improved "Review and eSign" user experience for Consumers. Here are some highlights:

- Lenders and Settlement Agents

- Lenders and Settlement Agents can now input the Signing Location of a closing in the closing create form.

- Lenders can now configure more recipients to receive the “Reminder to eSign unsigned documents 3 hours before the appointment” email.

- When replying to email notifications about comments made on the closing, that response will now create a comment on the closing.

- We're now offering more options for Consumer login preferences. (For more information on how to enable this, please contact your Customer Success Manager)

- We've added additional support for eSigning constraints on closings where the eNote needs to be signed on the same day as the Wet signing. (To configure this for your closings, please contact your Customer Success Manager)

- Going forward, Lenders and Settlement Agents will not be able to upload files that are larger than 60MB.

- Requesting a Notary from Closings

- If a Signing Range is provided, the system will not allow the Lender/SA to set the Signing Appointment out of that range.

- Parser

- We've added additional fields to support Full eClosings and Full eClosings with eNote

- Property Street Address, City, State, and Zip

- Borrower Street Address, City, State, Zip, and Last 4 of SSN

- We've added additional fields to support Full eClosings and Full eClosings with eNote

- General

- We've refined the logic for the Signing Appointment Range in the closing create form:

- If only the Latest Signing Date is provided, the Closing will not be created

- If only the Earliest Signing Date is provided, the Closing will be created, and the earliest signing date will be used as the tentative appointment

- If the Appointment Signing Range is provided with a start and end date, the Closing will be created, and the signing range will be displayed with the specified dates on the closing

- If no Appointment Signing Range or Appointment date & time is provided, the Closing will be created, and the appointment info will be displayed as "No Signing Range Provided" on the closing

- We've refined the logic for the Signing Appointment Range in the closing create form:

- Closings Integration

- For Lenders with Closings integration enabled, we've added some optional fields for Signing Location address, city, state, and zip.

Enhancements

Closings

- Settlement Agents

- When they are added to a Closing, their Sign-up page will be auto-filled with the information provided during the adding process. The auto-filled fields are still editable if a change needs to be made.

- Emails

- We've added some additional email settings for Lenders, allowing them to configure whether or not they would like to be notified of any errors that result from submitting a closing with invalid information.

Scheduling

- Quickbooks Integration

- Our system will now only sync Quickbooks data from orders with a status of "Closed". This should increase the rate of the syncing process.

Bug Fixes

Closings

- Lenders and Settlement Agents

- We’ve fixed the issue in which the “uploading” highlight was missing after Lenders and Settlement Agents had already finished selecting the file.

- We’ve fixed the pop-up issue when Settlement Agents would attempt to confirm adding addition documents.

- Consumers

- We’ve fixed the issue in which the “Thank you for eSigning your documents” banner displayed on the Consumer’s 2FA page.

- Ellie Mae Integration

- We’ve fixed the issue that mostly happened in Closings created with EMI, in which the eSigned docs had only populated partially signed documents from the Consumer.

Scheduling

- General

- We’ve fixed the issue in which the Notary Order did not require scanbacks, but in the reminder email sent to the Notary, the instructions included “require scanbacks”, causing confusion to both the Scheduler and Notary.

January 19, 2021 Product Release

New Features

Scheduling

- General

All the reviews given to the Notary will now only be visible to them 30 days after the order has been closed.

- Notary requested from a Closing

- Lenders, Settlement Agents and Schedulers will now be able to share messages with each other.

- Schedulers can now forward a message from Lender/Settlement Agent to the Notary.

- Schedulers will now be able to cancel orders regardless of who made the request for a Notary.

- If the associated Closing has been canceled, the request for a Notary will now also be cancelled

- Enhancements

Closings

- Parser

- We now support date range and signing date/time concurrently.

- SSO

- Copy update on login page for Lenders using SSO, to let them know that method has been configured

- When SSO is the only login method configured, the Lender login page will no longer display the username and password fields.

Scheduling

- Notary

- Notaries will now be able to update the signing status even if the appointment is in the past

Bug Fixes

Closings

- Lenders

- We've fixed the issue where the "include eNote" option was misaligned in the edit form on Closings with eNote.

- We've fixed an issue with a broken link that would not route a Lender user directly to the Closing when clicking on it.

- Consumers

- We've fixed the issue where Consumers, who have finished reviewing and eSigning their documents, were not met with the proper confirmation page.

- We've fixed an overlay issue in Internet Explorer when Consumers would reviewing their closing documents.

- We've fixed the issue where the "include eNote" option was misaligned in the edit form on Closings with eNote.

February Product Updates

Learn what’s new in Snapdocs this month

Increased Notary Outreach from 30 to 60

You may have noticed that the automator paused after notifying 30 notaries about a signing. To improve order management, we have increased the amount of notaries that the automator will reach out to at once. The Automator will now reach out to a total of 60 notaries before pausing.

How to get started: No action is required. Simply create a new order and start looking for a notary. You will notice this message in the “Activity” section.

Client Company and Client User Notes can be viewed on the order

To improve visibility, you will now be able to view personalized notes on each client company and client user directly on a Snapdocs order. These notes will now automatically populate at the top of every Snapdocs order. This enhancement will help reduce any missed requirements or client specific special instructions. These notes cannot be viewed by the Notary or Client User.

How to get started: Simply create an order and locate the Order Info section. There you will be provided with an option to edit or add notes on the Client Company and the Client User. Hit Edit on next to Client Instructions or User Instructions to input your notes.

Notaries can now set the document status

In an effort to improve order maintenance, notaries now have the ability to move the document status. Notaries were not able to write in a Signing Status unless the documents were marked as completed. When a signing appointment date/time has passed, the notary will now have the ability to mark how the documents were retrieved and input a signing status.

How to get started: No Action is required. This is solely an improvement for the notaries signing experience.

Pinning Orders on the Snapdocs Dashboard

We are excited to announce the ability to pin orders! This feature allows schedulers to pin orders that require additional attention or follow-up to the dashboard. Pinning orders to the dashboard grants visibility to the rest of the team and provides another avenue to easily provide the necessary support each order requires.

How to get started: Any open order has the ability to be pinned. Simply navigate to the order page and locate the “Pin order to top of owner's dashboard” underneath the Owner section. Select the check box and hit ‘Save.’ This order will now display at the top of the owners ‘Mine’ Section of the dashboard. Check out this support article for a video on how it works: Pinning an order.

Notaries can now see their “Notary Reviews”

To improve notary quality, Snapdocs will now allow Notaries to review written feedback. Sharing Feedback will allow transparency on performance by increasing cognizance. Your reviews will be shared anonymously and 30 days after the order has closed. These measures have been put in place to avoid any backlash from upset notaries.

How to get started: No action needed. Please review this Help Center article: Leaving Notary Feedback.

February 2, 2021 Product Release

New Features

Closings

- Lenders & Settlement Agents

- We've made some enhancements to the Dashboard view, making it easier to see the Preview Status, Signing Method, and if there is a Mobile Notary.

- We've also made the columns in the Dashboard customizable, so Users can display or remove the columns for a more streamline view.

- eNote

- In the Closing create form, if the eNote option is selected, an optional field to add the MERS number will populate.

- Emails

- We've updated some copy on the closing comment email notifications to make it clear, that replying directly to the email will generate a comment on the closing.

Scheduling

- General

- Client and User note's will now be made visible to the Scheduler on the Order Page.

- Notary and Client confirmation emails will now automatically be sent within 5 minutes of the Notary being assigned.

- We've increase the notary cap in the Automator from 30 to 60, allowing more notaries to be reached.

Enhancements

Closings

- Settlement Agents

- Settlement agents get an updated ability to edit appointment details directly in the UI.

- Consumers

- We're now including the file number in email notifications sent to the consumer, to help when referencing the closing for support inquiries.

- Consumers will now be able to download documents during Review.

- RON

- Lenders and Settlements Agents will be able to see the property address for RON signings.

- Lender will now receive the “Signed docs are ready for review” email once the wet signed package is available on Snapdocs.

Scheduling

- General

- If an order comes from ResWare, the “via resware” label will be displayed next to the order number.

Bug Fixes

Closings

- Consumer

- We've fixed a copy issue in the case when documents were not ready for Review, to make it clear to the consumer what the status of their documents are.

- We've fixed a copy issue when the consumer(s) opted out of eSigning to make it clear what will need to occur if the option is selected.

- We've fixed a copy issue on the eSigning completion page to be more instructional on next steps.

- We’ve removed the broken “Doc Download” button from the navigation bar in DocSign, which was unresponsive if clicked.

- Mobile

- We've fixed the text message to now display the wet signing appointment details, if applicable, when the eSigning has been completed.

- We’ve fixed the issue with the zoom function when reviewing the docs on a mobile device.

- Lenders & Settlement Agents

- We’ve fixed the issue in which the system did not remove the existing Signing range as well as the Appointment date when being deleted in Edit mode.

- We've fixed a copy issue on the Add Rush Docs pop-up, making it more clear when documents will be available on upload.

- We’ve fixed the issue in which the “Complete signing” button in the Lender UI returned an error when clicking on it.

- General

- We've fixed an error overlay issue for when a consumer phone number was missing.

- Ellie Mae Integration

- We’ve fixed the issue in which the scanbacks to Encompass was corrupted due to non-PDF files being uploaded as signed docs.

Scheduling

- Notaries

- We've fixed the link for notaries that directed them to the NNA, in order to be certified.

- General

- For companies with QuickBooks integration, we've fixed the email copy when an assigned Vendor transaction has been deleted to show more details on how to address.

- Notary requested from Closings

- We’ve fixed the issue in which documents were not automatically shared with the Notary once being uploaded to Snapdocs.

February 17, 2021 Product Release

New Releases

Closings

- Settlement Agents

- On login and during the signing up process, users will now be taken through 2FA to verify their identity.

- In the Closing Create Form, the signing location can now also be set.

- Lenders

- Lenders can now choose between multiple security authentication methods for SSO (Single Sign-On).

- Parser

- If a property address is included in the Closing email, we will now display it on the Closing UI as well.

- We've updated the logic to better handle various timezones submitted in Closing emails.

Scheduling

- Centralized Customers

- We've now expanded the ability to generate FedEx labels, so users can track their scanback packages.

Enhancements

Closings

- Parser

- We've made some changes to the logic to handle competing Closing data of “Earliest Signing Date”, “Estimated Closing Date”, and “Signing Time.

- RON

- For RON Closings, Settlement Agents will now be required to set the signing date and time directly in the UI before saving changes to the signing appointment field.

Scheduling

- General

- Anytime Client notes are changed, that event will now be recorded in the audit trail.

- Allow schedulers to pin/unpin orders to order dashboard.

Bug Fixes

Closings

- General

- We’ve fixed the issue in which the Closing UI did not return to its original state after removing the previously uploaded doc, rendering the Lender/Settlement Agent not be able to upload a replacement.

- We've fixed an issue that prevented a Hybrid closing to be converted to a Wet closing if the appointment was in the past.

- We’ve fixed the issue that caused the Appointment date to display as “Invalid” when only Appointment date is provided.

- We’ve fixed the issue in which 2 different time zones were displayed in the “Signing appointment is today” email to the Lender.

- We’ve fixed the issue in which the Activity log did not record the scanback upload for an ACP order.

- eNote

- Moving forward, when the Consumer declines eNote consent, it will trigger the eSigning opt-out in Snapdocs as well.

- RON

- We’ve fixed the issue in which the "eSigning Success" page showed “You'll be notified when the appointment details are finalized" even though the appointment date & time were set.

Scheduling

- Emails

- Moving forward, we will not attribute the Client confirmation email to be sent by the Scheduler.

- We've fixed an issue so automated Notary confirmation email will not go out, if the Appointment is in the past.

- General

- We’ve fixed the issue with 2FA for Mobile Notary registration.

- We’ve fixed the issue in which the Audit trail displayed the “Signing complete” under the wrong role, especially if the Notary has both an Agent account and Scheduler account.

- We’ve fixed the issue in which the Client admin wanted to move a preferred Notary to be displayed on the first page of the list but unable to do so.

March Product Updates

Learn what’s new in Snapdocs this month

New Dashboard Navigation

Schedulers can more easily see which orders are assigned to them with our new dashboard navigation. The scheduler dashboard can now be filtered to show all orders or just the orders assigned to a scheduler with the new 'All' or 'Mine' filters. With this new navigation option, schedulers can focus on their orders without getting distracted by orders that are not assigned to them.

How to get started: No action needed. Login into the scheduling dashboard to view.

Enhanced Automation Suite Settings

Snapdocs' Enhanced Automation Suite Settings allow you to find a high quality notary and confirm a signing in one click. With Enhanced Automation turned on, we provide settings to customize the way Snapdocs Automation will work for you. Once these conditions are set, your scheduling team will remove manually assigning notaries from their workflows.

How to get started: These settings are already available underneath ‘Company Settings.’ Only admin have the permission to alter these settings.

Auto Send Client Confirmation Emails

In an effort to automate manual tasks, Snapdocs Scheduling Confirmation emails will now automatically send after assigning a notary. The Scheduler will notice a 5 minute countdown until the Client and Consumer confirmation emails are sent. The logic behind the delay is to quickly remove any notaries before an email is sent to stakeholders. Schedulers will also have the options to “Send Now” or “Cancel” the confirmation email.

How to get Started: No action needed. This setting will be automatically turned on. If this new process does not fit your team's workflows, then your company can disable this underneath ‘Company Settings.’ Only Admin have the permission to alter these settings.

Snapdocs Verified

For companies with Snapdocs Verified turned on, there are additional preferences that can customize for your company to make that classification even more stringent. Your admin will set these conditions to ensure notaries meet the requirement necessary to complete signings.

How to get Started: These settings are already available underneath ‘Company Settings.’ Only admin have the permission to alter these settings. Here is a support article that will provide more details: Snapdocs Verified Preferences

Attorney Filter

In an effort to increase Notary Search efficiency, the ‘Search Agent’ section of the order now includes an Attorney Filter. By clicking the check box, you will be able to filter only notaires that are Attorneys. Please note that unclicking the check box will remove the filter.

How to get Started: No Action needed. Place an order and see for yourself!

Omni-Column

Snapdocs wants to ensure you have all the information needed when picking a notary. The “Omni-Column” will provide you with Notary success rates and counts on the product you select. The ‘Omni-column’ count can be found in the ‘Search notary’ section of the order. For more detail on Notaries feedback click directly onto the notary profile and navigate to ‘Order History.’

How to get Started: No Action needed. Place an order and see for yourself!

Learn what's coming soon!

Automatic FedEx labels and tracking

Your entire FedEx delivery workflow can now be automated with Snapdocs eliminating the need for your team to create and manually upload labels. Now, a FedEx return label can be automatically generated and uploaded with every order.

To get started, add the FedEx account number on the client settings page and then labels will be automatically generated under that account number. The label will be accessible under the 'Documents' section on the order page and available for the notary to download. The tracking number and shipping status will also be easily viewable on the order details page.

Client Invoice Updates

To ensure invoices are being sent to the appropriate people in a timely manner, we will send the invoice to your client’s accounting email that is entered on their client profile. This will allow invoices to be sent automatically to the accounting team when closing out an order.

For more information, please check out: Client Level Invoices

March 03, 2021 Product Release

Enhancements

Closings

- Moving forward, Consumers use their iPhone to review/eSign documents, the system will allow 2FA code to be auto-populated to their web browser (Safari or Chrome).

- The "Property address" fields are now available for Lender/SA in Closing Create Form. These fields are optional for Wet and Hybrid Closing, but required for Full eClosing. Note that if provided, the Property address must be a complete address in order for the Closing to be created.

- We've improved the doc-preview UI for Settlement Agents. Check it out and let us know how do you like it!

- Moving forward, the following emails will be sent from our no-reply@snapdocs.com:

- Email subject: Incomplete closing

- Email subject: Esign Incomplete

- Email subject: Please verify or set the signing appointment details

- To help improve the usability of the dashboard, the following enhancements have been made:

- Addition of a scrollbar at the top of the dashboard table, allowing for easy navigation across columns

- When sorting on a new column, you will automatically be redirected to the first page of results

- For admin users, the default filter will be set to “all closings” instead of “my closings”.

- We’ve made updates on the pop-up displayed to the Lender when they try to close a Hybrid Closing while eSigning is not yet complete.

Scheduling

- Moving forward, the system will update the Activity log and Audit trail everytime a new Order Owner is assigned.

- If the order owner is automatically assigned by the system, the activity log will display as <order_owner_name> assigned as order owner

- If the order owner is added by a company user, the activity log will display as <order_owner_name> assigned as order owner by <user’s name>

- To enable this feature, visit the Order settings and select “Set the scheduler who created the order (if any) as the order owner”.

- Moving forward, the Quickbook Sync will run until complete, and all errors will be included in one email (instead of stop syncing anytime an error was found like previously).

- The Quickbook Sync will include the client user email and file #.

General

- When a user has multiple roles (such as a Lender user and a Scheduler), and if any of those roles require using SSO for the login process, the user will be redirected to the SSO login page upon selecting the role from the profile menu.

Bug Fixes

Closings

- We've fixed the placeholder text in all appointment-related fields.

- We've fixed the issue with Settlement Agents not able to update the appointment date & time.

- Moving forward, when lender docs or title docs are removed from a Closing, the UI will automatically refresh to return to the pre-doc-upload state.

- We've fixed the issue with "Trust this device" feature for Settlement.

Scheduling

- We’ve fixed the issue with Client inviting a new member to the team, but the member got an error when trying to activate their account.

- We’ve fixed the issue in which the message sent to the Scheduler did not indicate if it was also shared with other recipients.

March 16, 2021 Product Release

New Releases

Closings

- Lenders, Settlement Agents, and Consumers can now create a comment on the closing by replying directly to the email notification when a comment is posted!

- Lenders can now enjoy the ability to automatically close their closings! Please contact your Customer Success Manager about turning this feature on.

Enhancements

Closings

- We've added some additional filtering/sorting functionality to the Closings dashboard to give Users the more freedom to customize!

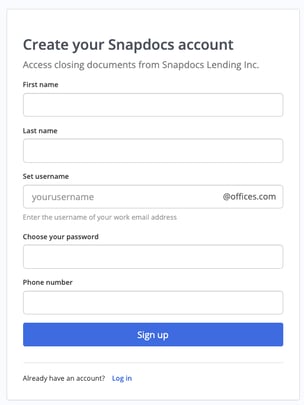

- Moving forward, when a brand-new Settlement Office is invited to a Closing, the signup screen will lock in the email domain used during invitation.

- We've updated the instructional text to the Consumer email when a comment has been made on a Closing, disclaiming that replying to the message will be sent to both the Settlement Office and Lender.

Scheduling

- We've made a small enhancement to allow for phone numbers with more than 10 digits, for seamless syncing with Notary's NNA information.

- Moving forward, if a Client has an accounting email in their profile, the system will send the invoices to that accounting email.

- If the accounting email is not provided, the invoices will be sent to the client user’s email.

- We've added some text formatting optionality to Client and User instructions.

Bug Fixes

Closings

- We’ve fixed the issue in which the Lender/Settlement Agent could not save the Closing after changing it from Hybrid to Hybrid with eNote.

- We've brought back the Send eSign Reminder tooltip!

- We’ve re-enabled the 2FA for all Settlement Agents.

- We’ve fixed the issue in which the signed eNote was not shown to the Lender.

- We’ve fixed the issue in which the Appointment details that were set during Closing creation was not showing in the Edit mode.

- We’ve fixed the issue with the Appointment details not displaying in the eSigning Success page, even though it was set prior to the Consumer start the eSigning.

- We’ve fixed the issue in which an SA with an existing client was sent to the registration form when clicking on the “You have a new closing” email.

- We’ve fixed the issue in which the “eSigning complete, signed documents available” email was not sent out to the Settlement.

- We’ve fixed the issue in which multiple time zones were displayed in the “Signing appointment is today” email sent to Lender and Settlement Agent.

- We’ve fixed an issue where Consumers would receive “Review your closing documents” or “Review & eSign your closing documents” depending on if eSigning is unlocked at that time, when converting from a Wet to Hybrid after documents have been processed.

Notary requested from Closings

- Moving forward, the Scheduler will not be able to open a canceled ACP order.

- We’ve fixed the issue in which the “Reminder to eSign” email was not triggered.

April 1, 2021 Product Release

New Releases

Closings

- General

- Settlement Agents will notice some slight changes to their Closing view for better navigation and clarity on actions items.

- Settlement Agents will notice some slight changes to their Closing view for better navigation and clarity on actions items.

- Dashboard

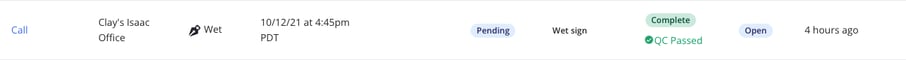

- Lender users and Settlement agents can now track the status of the wet signed docs!

- Complete – signed documents have been uploaded to the platform

- Pending – no wet signed documents have been uploaded to the platform

- Lender users and Settlement agents can now track the status of the wet signed docs!

Scheduling

- General

- We're happy to announce that we'll be integrating with SoftPro! This means additional options for a more streamlined Order management experience!

- We're happy to announce that we'll be integrating with SoftPro! This means additional options for a more streamlined Order management experience!

- Orders

- We've improved order navigation by allowing Schedulers to sort orders that were assigned to them versus all the orders assigned to their company by switching between the All and Mine tab!

- We've improved order navigation by allowing Schedulers to sort orders that were assigned to them versus all the orders assigned to their company by switching between the All and Mine tab!

Enhancements

Closings

- General

- We've updated the copy of the "Add Rush Doc" pop-up window to now display "Add Unsigned Document" and the sub-copy to display "Documents uploaded will immediately be added to the closing."

- Settlement

- We've updated the email copy to Settlement when additional documents have been added to the closing, making it more clear on which documents need downloading.

- Moving forward, when a Settlement Agent is being added to the Closing, they will only be notified AFTER closing docs have been uploaded.

- Consumer

- We've updated the copy on the "Who are you?" pop-up window for Closings with two Consumers sharing the same email address.

Bug Fixes

Closings

- General

- We’ve fixed the issue with a Co-Signer who had been removed from the Closing but was still able to access the closing docs.

- We've fixed a bug with the email invitation to new Settlement Agents pre-populating old data, when attempting to set up their account.

- We've fixed an intermittent issue when placeholder text for the Time & State Field did not always display.

- We've fixed the issue where newly added Settlement Agents were taken to the login page from “You have a new closing” email, instead of being prompted to set their password.

- eNote

- We’ve fixed the issue in which closing documents were not able to be removed while processing an eNote.

- We’ve fixed the issue in which closing documents were not able to be removed while processing an eNote.

- Consumer

- We've fixed an issue where the signing appointment details were not displaying in the Consumer dashboard.

April 13, 2021 Product Release

New Releases

Closings

- Settlement

- Settlement companies will now have the ability to use their Point of Sale/Transaction Processing System login credentials to log into Snapdocs. (Please contact your Customer Success Manager for more information)

- Settlement companies will now have the ability to use their Point of Sale/Transaction Processing System login credentials to log into Snapdocs. (Please contact your Customer Success Manager for more information)

Enhancements

Scheduling

- General

- We've added the ability for closing type and file number to the Orders created by our Resware integration. This will allow us to share updated information with the Order. (Please contact your Customer Success Manager to enable this)

- Moving forward, the Audit trail will display the user email of the logged event.

- Schedulers will notice an added "Notifications" tab to the left-sided navigation panel. This central location will allow the Schedulers to see all the notifications in one page, so that they can quickly go through them one-by-one. They can also select unread notifications so that they can view notifications for action items.

- We've updated the Personal Expense calculator to reflect the 2021 year rate.

- We’ve updated the label of the Import Pending Order popup Label to "Client" instead of "Lender".

Closings

- Lender

- We’ve added the “Other lender users” option to “A company team member adds a message” and “A settlement agent adds a message”. If checked, the company members who were added to the Closing will be notified when a message is added by another team member/Settlement Agent.

- If the Lender added a Favicon in their settings, that Favicon will now be displayed on the browser’s tab when the Consumer opens any Closing-related URL.

- Lenders can now select/deselect Settlement office for the following email settings:

- Consumer adds a message

- Settlement office hasn't added a signing status yet and it's 2 hours after the appointment

- It's the day of the signing

- Lenders can now select/deselect Consumer for this particular email in the email setting

- Documents are available

- Settlement

- We've updated some minor text changes to the 2FA prompt to Settlement Agents.

- If only an estimated start date of a signing range is provided during the Closing creation, when displaying the “Available signing range”, the text will be: “On or after MM/DD”.

- Emails

- We've updated the following email triggers:

- When a Settlement Agent sets/changes the appointment details. Email communications triggered by this action will reflect either:

- A notary request has been placed (so the text would mention something about notary)

- No notary request/Notary request has been canceled (so the text would not mention anything about a notary)

- When rush docs are added. Email communications triggered by this action will reflect either:

- A notary request has been placed (so the text would mention something about notary)

- No notary request/Notary request has been canceled (so the text would not mention anything about a notary)

- We've updated the text of the “Review” email to included red highlighted lines when Closing has two or more Consumers

- When a Settlement Agent sets/changes the appointment details. Email communications triggered by this action will reflect either:

- We've updated the following email triggers:

Bug Fixes

Scheduling

- We’ve fixed the issue in which the system did not include the accurate count of uploaded files in the email sent to the assigned Notary.

Closings

- We've fixed an issue where all the placeholder text of the associated fields in ACP form did not always display.

- We've fixed the issue where the Settlement would receive the “You have a new closing” email every time closing docs are removed. Now they will only receive it once, when the closing docs are uploaded for the first time.

- We've fixed an issue where an email notification to Settlement only referred to one Consumer in a dual-Consumer Closing.

April 20, 2021 Product Updates

New Feature

Lender adds signed documents

Lenders now have the ability to upload signed documents to the Closing, which up until recently, was only allowed by Settlement Agents.

Feature benefits

Lenders can proactively speed up the process to complete Closings and fund loans.

User flow

Once the signed docs have been received by the Lender, simply drag and drop the PDF file into the UPLOAD SIGNED DOCUMENTS panel, then click Complete signing:

After clicking Complete signing, the Appointment status will show that it's Complete:

And the closing status will change to be “Signed, ready to close”.

Note:

- Settlement Agents will not be able to delete the signed documents you uploaded.

- Both you and the Settlement Agents can add more signed docs to the Closing as long as the closing status is still “Signed, ready to close”.

May 04, 2021 Product Updates

New Features

Adding digitized title documents to full eClosings with Remote Online Notary

In Sep 2020, we launched Hybrid closings with automatically digitized title documents, a new feature that allows Settlement Agents to experience the full benefits of a digital closing with the ability to upload their title documents for eSigning.

Today, we’re expanding that ability to all full eClosings with Remote Online Notary.

| Lender’s view | Settlement’s view |

|

|

Feature benefits:

- The Consumer can review and eSign more documents ahead of the appointment.

- Lender and Settlement companies no longer need to manually digitize their documents.

Snapdocs and eOriginal partnership

Snapdocs' eVault integration is adding eOriginal to its suite, providing a seamless process for secure storage and management of the eNote from beginning to end of the closing process.

To learn more about this partnership, please reach out to your Snapdocs Customer Success Manager.

Enhancement

Canceling a notary request

Moving forward, when the Lender or Settlement cancels a closing, Snapdocs will cancel the notary request if the signing is not yet complete.

If the signing is already complete, we will keep the request as is, and the Scheduling company will proceed with the invoice.

Bug Fixes

We fixed the following bugs:

- “Consumer opts out of eSigning” email did not send to the Consumers.

- “Please verify or set the signing appointment” email did not send to the Settlement and Lender.

- The Settlement uploaded all title documents, but the user interface displayed as “title package has been skipped”.

May 19, 2021 Product Updates

New Feature

Classifying eSigned documents before returning them to Encompass

Snapdocs now offers the ability to classify and index eSigned documents automatically in Encompass, regardless of whether they have barcodes.

Feature benefit:

Using this feature will save closers and funders time by allowing them to have documents pre-sorted before arriving into Encompass and decreasing reliance on the auto-assign feature.

To learn more about this feature, please reach out to your Snapdocs Customer Success Manager.

Enhancements

Differentiating the signed documents' component in Lender's view and Settlement's view

We are updating the label of the signed documents' components to reflect the different usage of each role:

- Lender user: access signed documents or upload signed documents if necessary.

- Settlement Agent: upload signed documents and send them to the Lender.

| Lender’s view | Settlement’s view |

|

|

Including file number in the “eSigning complete” email

If a Hybrid/Full eClosing has a file number, the file number will be included in the email’s subject.

Consolidating all triggers related to Appointment details into one email setting

The new email setting -- Appointment details are changed -- will trigger the email notification when the date, time, or signing location changes.

Switching from @snapdocs.com to @mail.snapdocs.com domain

Snapdocs is planning to implement a security change to protect our customer's data. This change will impact all emails from the Snapdocs platform, in which the FROM email header will display "no-reply@mail.snapdocs.com." You may need to whitelist the @mail.snapdocs.com domain.

Your Snapdocs Customer Success Manager will be reaching out to let you know the exact date Snapdocs will be enabling the change. We recommend you to contact your IT Department to whitelist the @mail.snapdocs.com domain by June 7.

Note: This change only applies to emails. It does not affect your company's Snapdocs URL.

Bug Fixes

We fixed the following bugs:

- “Other Lender users” were still receiving emails even when the Lender Admin had unchecked that option in email settings. We have now fixed this and emails to “Other Lender users” will appropriately reflect email settings.

- The affected email settings are below:

- Document are available to eSign

- Document are available to preview

- Rush documents are added

- The affected email settings are below:

- The system incorrectly triggered the “Closing type changed” emails, and the emails included incorrect verbiage.

June 08, 2021 Product Updates

Closing API

The Closings API is a set of Public APIs for Lenders to integrate their LOS with Snapdocs. It provides a scalable and secure process for creating, tracking, and updating transactions in Snapdocs. The APIs can also send the signed closing documents back to the Lender. The Closings API allows Lenders to get massive efficiency gains that result in faster Closings and lower costs without the need to leave their LOS environment.

Feature benefits:

- It automates the complete Closing process from creating, tracking and updating Closings, and getting signed documents back, all from within the LOS.

- It increases internal and external security around the Snapdocs closing create process.

How does the feature work?

Snapdocs provides a set of Public APIs to enable Lenders to take the following actions directly from their LOS:

- Authenticate

- Create a Closing

- Send Closing Documents to Snapdocs

- Get a list of Documents on the Closing

- Download Documents from the Closing

- Subscribe to Closing Status Webhooks

- Preview Status

- eSign Status

- Final Documents Available

Please reach out to your Snapdocs Customer Success Manager for more information about integrating Snapdocs Closing API.

Ellie Status Updates

We are adding a new feature to the existing ability to connect into a Lender's Encompass instance. "Ellie status updates" allows Snapdocs to push back Closing status updates (Document Status, Preview Status, eSign Status, etc.) to the associated loan in Encompass, making it more intuitive for Lenders to track the Closing statuses without leaving Encompass.

Feature benefits:

- Lenders will not need to monitor email or log into Snapdocs to see the current status of Closings, making them much more efficient as they are able to live within their system of record.

- Lenders can now create dashboards and automation within Encompass based on the Closing status.

- Lending team members who do not have access to Snapdocs can still get visibility into the Closing status directly from Encompass (or an external system that they draw Encompass info into).

How does the feature work?

Snapdocs will push back updates/statuses as they occur within Snapdocs into Encompass for the following activities:

- Overall Closing Status

- Document Status

- Doc Preview Status

- eSign Status

- Appointment Status

- Closing URL

Please reach out to your Snapdocs Customer Success Manager for more information about the Ellie Status Updates feature.

Enhancements

Updating Lender’s closing create form

We are updating the closing creation form to provide a consistent experience for both Lenders and Settlement when manually create closings in Snapdocs.

| Lender’s UI | Settlement’s UI |

|

|

Adding scanbacks events to the Audit trail

To help track the status of scanbacks in closings created by the Snapdocs-Encompass integration, we are adding the following events to the Audit trail:

- Snapdocs successfully pushed documents to Encompass

- Error: Snapdocs failed to push documents to Encompass

Updating the email content when rush documents added to the closing

We are updating the email content to be more informative to all parties in the closing. Use the following table to reference the improved emails’ subjects and contents when rush documents are added to the closing:

| Trigger | Notary assigned (Y/N) | Email recipient | Email subject | Email text |

| Lender adds rush documents | No | Settlement office | Documents Updated - File #xxxxxxx |

Hello [name], [Lender name] updated documents for file #xxxxxxx. Download the updated documents and use at the signing appointment. |

| Other Lender roles | Documents Updated - File #xxxxxxx |

Hello [name], [Lender name] updated documents for file #xxxxxxx. Download the updated documents and use at the signing appointment. |

||

| Yes | Settlement office | Documents Updated - File #xxxxxxx |

Hello [name], [Lender name] updated documents for file #xxxxxxx. Download the updated documents and use at the signing appointment. The notary has been notified of these additional documents. |

|

| Other Lender roles | Documents Updated - File #xxxxxxx |

Hello [name], [Lender name] updated documents for file #xxxxxxx. Download the updated documents and use at the signing appointment. The notary has been notified of these additional documents. |

||

| Settlement adds rush documents | No | All Lender roles | Documents Updated - File #xxxxxxx |

Hello [name], [SA name] updated documents for file #xxxxxxx. Download the updated documents and use at the signing appointment. |

| Yes | All Lender roles | Documents Updated - File #xxxxxxx |

Hello [name], [SA name] updated documents for file #xxxxxxx. Download the updated documents and use at the signing appointment. |

Improving the logic of the “You have a new closing” email

The new logic includes:

- The Settlement office and Settlement Agent will receive the “You have a new closing” email AFTER the system has processed closing documents.

- If a Settlement office’s email address is the same as a Settlement Agent’s email address, the system will only send one “You have a new closing” email to the address for each Closing.

Improving the content of the “Consumer has finished eSigning” email

In Hybrid and full eClosing, if a Notary is assigned to the closing, the system will inform them as soon as the Consumer completes eSigning the documents, as well as what documents need to download for the wet signing.

We are updating the email content to provide more clarity to the Notary:

Bug Fix

One of our closing integration with Encompass, Scraper, uploaded error-prone documents to a closing, causing failure when the system tried to combine them.

The fix will ensure Scraper checks the download server's response status before uploading documents to Snapdocs.July 01, 2021 Product Updates

New: Added Support for Consumers' Middle Name and Suffix

Companies can now send Consumer’s full name that includes middle name and suffix to Snapdocs for Closing creation. This new feature is important to support the reconciliation and correct mapping between Snapdocs and MERS eRegistry.

When creating a Closing manually, you will notice a “Middle Name” field and “Suffix” field. These fields are optional, as shown in the following screenshot:

When creating a Closing using either Snapdocs Closing API, Snapdocs - Encompass integration, or Encompass Parser, you can include the Consumer’s middle name and suffix in the Closing data.

Note: If the Consumer’s name has a middle name and/or suffix, DocuSign will generate an e-signature using the entire full name for eSigning:

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

Enhancements

Sending email notification to the Settlement office when someone leaves a message on the Closing

When someone leaves a message on the Closing, the system will always send an email notification to the Settlement office. This enhancement will ensure no communication gap between the Settlement office, Settlement Agent, and Lender.

Updated the verbiage of emails to Encompass users

We have updated the verbiage from “"Encompass Consumer Connect" to just "Encompass". The affected emails are:

- Closing is complete.

- eSign incomplete.

Can now send wet signed documents to Encompass after the Lender/Settlement Agent converted the Closing to Wet Closing

In Hybrid Closings, if the Consumer has wet-signed all documents, the system will send the signed documents to Encompass once the Lender/Settlement Agent uploads the signed documents AND convert the Closing to a Wet Closing.

Will not allow Lenders/Settlements to cancel “Did not sign” orders

We will not allow the Lenders or Settlements to cancel the orders with the “Did not sign” status. This change will enable the Notary to collect their travel or print fee due to the order canceling through no fault of their own.

Bug Fixes

We fixed the following issues:

- The Activity log did not show when the Notary downloaded title documents.

The fix ensures this event will be recorded, as shown in the following screenshot:

- The Settlement Agent received the “Incomplete closing” email after uploading signed documents to the Closing.

The fix ensures the system will not send the email if the Settlement Agent uploads signed documents within 1 hour of the appointment time. - The Lender user was able to delete unsigned documents uploaded by the Lender admin.

The fix ensures the system checks if the Lender user is authorized to access the Closing or not. If not, the Lender user will not be able to delete closing documents. - Borrowers were unable to get past the SSN entry when eSigning the eNote. The main reason is that they cannot see what they are typing due to the digits being represented as asterisks, causing mistyping.

The fix ensures the Borrowers can toggle between asterisks/digits to verify they have input the correct SSN. - A Participant could not see the eSigning status of the Closing.

The fix ensures the system fetches all the latest statuses to the Participant’s view. - The Settlement office received the “Notary assigned” email with the wrong embedded link, preventing the Settlement office from viewing the order.

The fix ensures the embedded link is of the right company. - When using the Closing API, if the

mark_finished_uploading_documentsis called twice, the system returned a 500 Error.

The fix ensures the system returns a 409 Error, with the error message as: “The documents have already been marked as ready for processing.” - Validation of the data for the Closing incorrectly failed due to the email address being case sensitive.

The fix ensures email addresses of varying uppercase and lowercase letters will be treated the same. For example, the three email address of First.Last@a-hotmail.com, randy.marsh@a-hotmail.com, and FIRST.LAST@a-hotmail.com will all match as the same user, and the system will accept all three variations.

July 14, 2021 Product Updates

New: Introduce QR Code Wet Sign Cover Page

We are piloting a new feature that automatically adds a cover page with a QR code to the wet sign package. When scanning this QR Code, the signing agent (Notary or SA) will be able to verify if the Consumer has eSigned the documents. If not, the Consumer can simply scan the QR Code and complete eSigning prior to wet signing the remaining documents.

Feature benefits

- Ensure Consumers will always complete eSigning.

- Eliminate technical issues when Consumers eSign on their own, prior to the appointment.

- Eliminate the complications of converting the Closing to Wet at the signing table.

- Support Hybrid Closings with multiple Consumers.

- The following is the cover page with the QR Code included:

When scanning this QR Code, the signing agent (Notary or SA) will be able to verify if the Consumer has eSigned the documents:

To eSign, the Consumer will scan the QR code, then click eSign to start the process. The link is valid for 14 days from the date of wet sign package generation.

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

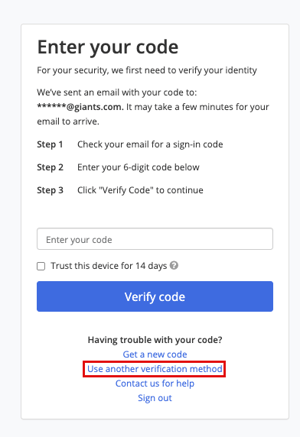

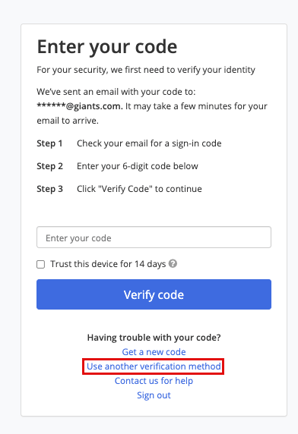

New: Allow Settlement Agents to receive 2FA code as a text or voice call

Settlement Agents can now opt to receive their 2FA code as a text/call to their phone number. To do so, select Use another verification method from the 2FA page:

New: Title Consent for full eClosings

Lenders using Encompass can now send an email to the Settlement Agent on the loan asking if they consent to conducting it as a full eClosing.

The system will send the following email to the Settlement office regarding the Title Consent request:

The Settlement office will click on Consent to full eClosing to access the Title Consent form:

Notes:

- The Lender can send a Title Consent before or after creating the full eClosing.

- If the Settlement Agent declines the Consent of an existing eClosing, the Lender will need to cancel this Closing.

- The Settlement Agent can revisit the declined Consent and accept it.

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

Enhancements

Added “Settlement office” to the “Rush Documents are Added” email setting

Lender admins can now configure “Settlement office” to receive an email notification when a rush document is added to the Closing:

Updated the “eSign your closing documents” email

We have updated the copy to be: “Please eSign your closing documents on your preferred device before the appointment. If you have any questions, please contact your lender or settlement agent in this signing platform.”

Bug Fixes

We fixed the following issues:

- The Lender user was able to access and comment on a Closing created by the admin.

The fix ensures the system checks if the Lender user is authorized to access the Closing or not. If not, the Lender user will not be able to comment on the Closing. - Closing API - The system did not save the Settlement office’s address sent with the closing data.

The fix ensures the system saves the provided address in Root and displays the address in the Closing UI.

August 04, 2021 Product Updates

New: Send auto-reminder to the Settlement Agent to upload documents

We are launching an auto-reminder feature to help Settlement Agents upload documents on time for the signing.

The system will send an auto-reminder to the Settlement Agent when either:

- The signing is happening in less than two hours, but the system detects no documents or the document status has not been set; OR

- The signing is happening in the morning of the following day, but the system detects no documents or the document status has not been set; the system will send the auto-reminder to the Settlement Agent at 4 pm today.

The system will post the reminder in the Activity log of the Settlement’s view and the order page. The Settlement Agent/Settlement office will also receive an email notification, as shown in the following screenshots:

The Activity log of the Settlement’s view:

The Order’s Activity log:

The email to the Settlement office:

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

New: Send auto-reminder to the Notary to upload scanbacks

If the signing order requires scanbacks and the system detects no scanbacks uploaded after two hours, then it will automatically send a reminder message to the Notary to upload signed documents in the order.

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

Enhancements

Made the QR Code accessible once generated

If the Consumer cannot eSign at the moment due to an eSign constraint when scanning the QR code, the signing agent (Notary or SA) will see the following information:

Please reach out to your Snapdocs Customer Success Manager for more information about the QR Code Wet Sign Cover Page feature.

Updated the instructional text of the Upload Signed Documents section

The new text is: “Upload signed documents. These will be shared directly with your lender.”

Updated Lender’s Closing UI

We have updated the Lender's Closing UI to help streamline the user experience and reduce the visual clutter.

Added additional Scanbacks upload reminders to the email settings

We have added two additional email reminders to the email settings:

- Settlement office hasn't added a signing status yet and it's 1 day after the appointment; and

- Settlement office hasn't added a signing status yet and it's 3 days after the appointment

These emails are configurable. By default, the system will turn them on for all Lenders.

Full eClosing with digitized title documents: added the ability to skip title documents

Both Lender users and Settlement Agents can skip uploading title documents from the Closing UI, as shown in the following screenshots:

| Lender’s view | Settlement’s view |

|

|

Bug Fixes

We fixed the following issues:

- When the Lender/Settlement Agent updates a signer’s information, the system deactivates the closing user and re-creates a new closing user. This practice caused issues for sending the 2FA code to the active closing user.

The fix ensures the system looks for the active closing user and sends the 2FA code to that active user. - Some Closings did not appear in the search results when using the search bar in the dashboard. These closing users appear to have no value in the

last_namefield in the database.

The fix ensures the system searches for the last name in theclosing_userfield instead of theuser_recordfield. - “Other Lender users” were still receiving emails even when the Lender Admin had unchecked that option in the “Original closing package is updated” email setting.

The fix ensures emails to “Other Lender users” will appropriately reflect email settings. - Snapdocs' integration received closing data in which the Consumer's phone number was missing. This Consumer is an existing user, with their user profile containing both a phone number and email address. When creating the Closing, the system displayed the phone number on the Consumer's journey of the new Closing, but the Consumer never received a notification to review documents.

The fix ensures the system does not display any missing information in the closing data sent to Snapdocs and will display an error message on the Closing UI to alert both the Lender and the Settlement Agent.

August 18, 2021 Product Updates

New: Document Redraw

We are launching a new solution that will seamlessly support document redraws for Lenders without leaving their LOS.

Feature benefits:

- Minimize the time it takes Closers to order a redraw (only order redrawn documents).

- Ensure the Settlement Agent (or Notary) gets the new redrawn documents.

- The Settlement Agent (or Notary) only needs to print the redrawn documents.

- Individual redrawn documents are logged in Disclosure Tracking.

- If the Consumer has not completed eSigning, their eSign package is updated with the redrawn documents.

How does it work?

Once the system has processed the original documents, if needed, the Lender can send the documents that need to be updated to Snapdocs.

After the system has located the correct Closing, it will start the redraw process, in which:

- If the Lender provides wet sign documents; the system will add them to the wet sign package and remove the old version.

- Suppose the Lender provides eSign documents, and no Consumers have eSigned. In that case, the system will add the eSign documents to the eSign package and remove the old version.

- If the Lender provides eSign documents, and any of the Consumers have eSigned, the system will add them to the wet sign package.

As soon as the redraw process is complete, the system will notify the Settlement Agent/Notary if the wet sign package was updated.

If the eSign package was updated, the Consumer’s eSign package would be updated.

While documents are in the redraw process, the Lender’s UI will look like the following screenshot:

Here is the Settlement’s UI during the document redraw process:

-

If the Consumer is accessing Snapdocs to review and eSigning the documents during the document redraw process, the system will inform them with the following message:

If the Consumer is accessing Snapdocs to review and eSigning the documents during the document redraw process, the system will inform them with the following message: Here is the Lender’s UI after the document redraw process has been completed:

Here is the Lender’s UI after the document redraw process has been completed: Note:

Note:- If the signing appointment is less than two hours away, all redrawn documents will be added as “rush documents” which skip doc processing and are sent instantly to the Settlement Agent/Notary as wet documents.

- If the Settlement Agent has already downloaded the original wet sign package, after the system has completed redrawing the wet sign documents, it will display the Redraw Documents as a separate package, as shown in the following screenshot:

- If the Lender removes the closing package after the redraw has completed, the system will remove the original package + split packages + redraw packages. If the Closing has rush documents, the system will not remove them in this case.

- If the Lender/Settlement Agent converts the Closing from a Hybrid to Wet after the redraw has completed, their Closing UI will look slightly different than the typical Wet Closing, as shown in the following screenshots:

The Audit trail will record the following redraw-related events:Lender’s UI

Settlement’s UI

Redraw documents marked as finished uploading

Redraw documents split

Rush document(s) added to closing

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

New: Snapdocs Full eClosing Eligibility Form

To power our Lenders who are Encompass users and wanted to adopt full eClosing with Remote Online Notarization, Snapdocs has designed a unique tool called RON e-Eligibility. Using this tool, the Loan officers can instantly check if a given loan is eligible for Remote Online Notarization before opening a Closing.

-

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

Enhancements

Updated the copy of the eSign status

We have updated the copy of the eSign status to be “Consumers can eSign documents on any supported device.”

Add Lender’s logo to the footer of the QR Code Wet Sign Cover Page

The system will automatically include the Lender’s logo in the footer of the cover. If the Lender’s logo is not available for some reason, the system will display Snapdocs’ logo instead:

Please reach out to your Snapdocs Customer Success Manager for more information about the QR Code Wet Sign Cover Page feature.

Allow the removal of the Co-signer’s email address in the Edit form

If needed, Lenders/Settlement Agents assigned to the Closing can now remove the Co-signer’s email address in the Edit form.

September 01, 2021 Product Updates

Enhancements

Record in the Activity log when the Consumer downloads signed

The recorded event will be: “Borrower <borrower_name> has downloaded returned_combined_documents.pdf.

Display the date and time the Consumer can eSign to the QR Code Wet Sign Cover Page

If the date and time the Consumer can eSign have been set, the system will display it on the cover page.

Please reach out to your Snapdocs Customer Success Manager for more information about the QR Code Wet Sign Cover Page feature.

Allow the Consumer to re-select the phone number when completing 2FA step

In Hybrid Closings or full eClosings with Consumers sharing the same email address but have a different phone number: when accessing Snapdocs to eSign documents, they will need to complete the 2FA step.

If they mistakenly select the incorrect phone number to receive the 2FA code during this process, they can click on Picked the wrong phone number? Go back to come back to the “Ready to verify your identity” screen.

Enable DocuSign to handle the Consumer’s change of email address

To help streamline the overall experience when managing Closings in Snapdocs, we have implemented a solution that enables the system to immediately update the Consumer’s new email to DocuSign when the Lenders or Settlement Agents update the Consumer’s email address, instead of restarting the Doc Process as done before.

The system will also re-send the “Review your closing documents” or “Review and eSign your closing documents” email to the new email address.

Bug Fix

We fixed the following issue:

- The “Back” button of the “Text Sent to” popup did not respond when clicking.

The fix ensures this button will take the user back to the previous screen of the 2FA setup.

September 15, 2021 Product Updates

Enhancements

New configuration for the Auto-close feature

Lender companies can now select which number of days a Closing has to stay inactive before being closed automatically. The options are:

- 15 days

- 30 days

- 45 days

Add redraw documents from the Closing UI

Lender users can now upload redrawn documents from the Closing UI:

Please reach out to your Snapdocs Customer Success Manager for more information about the Document Redraw feature.

Added “Escrow ID” field to the Closing Create form

The Lenders can use this field to include an Escrow ID (Title unique Identifier) to the Closing.

Once the field is populated, the system will display the Escrow ID Source field, as shown in the following screenshot:

If provided, the Escrow ID will be displayed in the Reference Numbers section located on the bottom right of the Closing UI:

Please reach out to your Snapdocs Customer Success Manager for more information about this newly added field.

Bug Fixes

We fixed the following issues:

The system triggered Doc Process after the Lender/Settlement Agent saved the Edit form without updating closing information.

The fix ensures the system triggers Doc Process only when critical information such as the Consumer’s first name or last name is updated or when Co-Signer(s) is added to the Closing.

We have updated the text to be: “To change these preferences, please contact your Customer Success Manager.”

The system did not unlock the documents for eSigning after the Lender/Settlement agent set the appointment to be on the same day.

The fix ensures the Consumer can access eSigning immediately once the appointment happens on the same day.

October, 2021 Product Launch

Document Redraw

We are launching a new solution that will seamlessly support document redraws for Lenders without leaving their LOS

Key benefits:

- Minimize the time it takes Closers to order a redraw (only order redrawn documents).

- Ensure the Settlement Agent (or Notary) gets the new redrawn documents.

- The Settlement Agent (or Notary) only needs to print the redrawn documents.

- Individual redrawn documents are logged in Disclosure Tracking.

- If the Consumer has not completed eSigning, their eSign package is updated with the redrawn documents.

- Support Wet, Hybrid, Hybrid with eNote, full eClosing, and full eClosing with eNote.

How does it work?

Once the system has processed the original documents, if needed, the Lender can send the documents that need to be updated to Snapdocs.

After the system has located the correct closing, it will start the redraw process, in which:

- If the Lender provides wet sign documents; the system will add them to the wet sign package and remove the old version.

- Suppose the Lender provides eSign documents, and no Consumers have eSigned. In that case, the system will add the eSign documents to the eSign package and remove the old version.

- If the Lender provides eSign documents, and any of the Consumers have eSigned, the system will add them to the wet sign package.

As soon as the redraw process is complete, the system will notify the Settlement Agent/Notary if the wet sign package was updated.

If the eSign package was updated, the Consumer’s eSign package would be updated.

While documents are in the redraw process, the Lender’s UI will look like the following screenshot:

If the Consumer is accessing Snapdocs to review and eSigning the documents during the document redraw process, the system will inform them with the following message:

Here is the Lender’s UI after the document redraw process has been completed:

Note:

- If the Settlement Agent has already downloaded the original wet sign package, after the system has completed redrawing the wet sign documents, it will display the Redraw Documents as a separate package.

- If the Lender removes the closing package after the redraw has completed, the system will remove the original package + split packages + redraw packages. If the closing has rush documents, the system will not remove them in this case.

- If the Lender/Settlement Agent converts the Closing from a Hybrid to Wet after the redraw has completed, their Closing UI will look slightly different than the typical Wet Closing.

- The Audit trail will record the following redraw-related events:

- Redraw documents marked as finished uploading

- Redraw documents split

- Rush document(s) added to closing

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

Closing Quality Control

Closing Quality Control (CQC) is a Snapdocs technology to classify scanbacks into their appropriate Encompass eFolder and check for missing pages or documents in the scanbacks (relative to the initial loan package).

Key benefits:

- Classify both eSigned and wet signed documents, and upload them to the appropriate eFolder in Encompass.

- Alert the Lender via email of any missing pages or missing documents when the scanback happens.

The CQC progress is visible on both the Lender dashboard and the closing UI:

“CQC in progress” indicator:

“CQC Passed” indicator:

“Possible Errors” indicator:

Please reach out to your Snapdocs Customer Success Manager for more information about this feature.

October 05, 2021 Product Updates

Bug Fixes

We fixed the following issues:

- In Closings created by the Parser, if the primary signer did not have an email address, the system automatically filled in the primary signer’s email field with the secondary signer’s email address if one exists.

The fix ensures the system parses the email address accurately. If the primary signer’s email address is missing for a Hybrid Closing, the system will return an error. - The Lender could not edit any closing data of a Closing that has the appointment in the past.

The fix ensures the Lender can update non-date/time closing data even when the appointment has already in the past. If the Lender updates the past appointment, the new date and time must be in the future.

October 19, 2021 Product Updates

Enhancements

Lender role-based access

When adding or modifying a member of the Lending team, the Lender admin will need to assign which access level the new member will have. There are two predefined levels to select from:

- Closing Editor -- Can only access and edit Closings they have been assigned to.

- Admin -- Can access and edit all Closings and make changes in the company settings.

The existing users with the “Non-admin” role will be converted to the “Closing Editor” role in Snapdocs.

Update Notarize when the Settlement Agent is added/removed from the Closing

When a Settlement Agent is added/removed from the Closing, the system will update Notarize order accordingly.

Updated the time zone logic for unlocking eSigning

In Hybrid with eNote or full eClosing with eNote, if either:

- “eSign on the day of the wet signing” constraint; or

- “eSign on the day of the wet/RON signing for all closings with an eNote” constraint

is enabled, the Consumer will be able to eSign at midnight in the time zone of the Closing only if the time zone is one of the following:

- Hawaii-Aleutian time

- Alaska time

- Pacific time

- Mountain time

- Central time

If the time zone of the Closing is on Eastern time, the system will unlock eSigning at midnight Central time.

The following example will give you more clarity on this improved logic:

- If the eSign constraint is set to be “on the day of the wet signing” or “eSign on the day of the wet/RONsigning for all closings with an eNote”

- Suppose the signing location(*) is in New York:

- If no appointment exists, eSigning will not be unlocked until an appointment is set.

- If an appointment is provided, eSign will only be unlocked at 12:00am CDT on the appointment date.

- Suppose the signing location(*) is in New York:

- If the eSign constraint is set to be “on the earliest date of the signing range”:

- Suppose the signing location(*) is in New York:

- If no signing range or appointment exists, eSigning will not be unlocked until either signing range or appointment is set.

- If a signing range is provided, eSigning will be unlocked at 12:00 am CDT on the start date of the signing range.

- If an appointment is provided, but no signing range is provided, eSigning will be unlocked at 12:00 am CDT on the appointment date.

- Suppose the signing location(*) is in New York:

(*) In full eClosing and full eClosing with eNote, it will be the property location.

November 02, 2021 Product Updates

Enhancement

Include the eNote Certificate to the eNote package

The system will add the eNote Certificate to both the combined packaged and the eNote package.

Bug Fix

We fixed the following issue:

The dashboard did not display the correct closer name when a new closer was assigned to the Closing.

The fix ensures the dashboard to display the most recently assigned closer.

November 17, 2021 Product Updates

Enhancements

Digital Closing - Make the closing urls more generic

We have updated the code to make the closing URLs more generic by using only the closing UUID (e.g., https://bettermortgage.snapdocs.com/closings/2be22b2a-6a01-4719-9c71-e4c1c78616e4).

This improvement will allow the closing URLs to remain the same if the consumer’s last name or the file number is updated after the closing has been created.

Closing Quality Control - Classify existing signed documents for “Open” closings when onboarding new lenders to the feature

The system will start classifying all existing signed documents in closings with “Open” status right after enabling the feature for a lender.

Updated the session timeout for settlement agents

The new duration of an active session is 4.5 hours.

December, 2021 Product Launch

Lender Dashboard Improvements

We are adding two important features to the lender dashboard: Export closing and Bulk close files.

Export closing

Any lender user can export all of their closings by clicking on the “Export current view” button from the dashboard.

After the system has completed the export, it will send an email to the lender user, as shown in the following screenshot:

Bulk close files

Lender admins can close all qualified closings by clicking on Close files. The system will highlight which closings are qualified to be closed, as shown in the following screenshot:

To close those closings altogether, click Close files again. The system will display the following pop-up:

Click Continue to confirm.

A notification will display after all qualified closings have been closed successfully.

Note: Closings that are qualified to be closed need to meet the following criteria:

- For wet closings:

- The In-office singing is marked as complete.

- For hybrid and full eClosing:

- The eSigning is marked as complete; and

- The In-office singing is marked as complete.

Full Document Redraw

Redraws are a common occurrence for many of our lenders. Up to 50% of closings are subject to redraws, often with only a few documents in the package changing.

Using the redraw feature, the lenders can easily request a document redraw, as well as updating closing information without leaving their LOS.

Feature benefits

- Minimize the time it takes closers to order a redraw (only order redrawn documents).

- Ensure the settlement agent (or notary) gets the new redrawn documents.

- The settlement agent (or notary) only needs to print the redrawn documents.

- Individual redrawn documents are logged in Disclosure Tracking.

- If the consumer has not completed eSigning, their eSign package is updated with the redrawn documents.

- If the consumer has already eSigned, Snapdocs will notify them of the document change via email, and allow them to review the replaced documents.

How does it work?

- After the system has processed the original documents, if needed, the lender can send the documents that need to be updated to Snapdocs, or send a new closing package to replace the original one.

- Snapdocs will match the GUID (if provided), file number, and consumer info provided to the original closing. After the system has located the correct closing, it will start the redraw process, in which:

- If the lender provides wet sign documents; the system will add them to the wet sign package and remove the old version.

- Suppose the lender provides eSign documents, and no consumers have eSigned. In that case, the system will add the eSign documents to the eSign package and remove the old version.

- If the lender provides eSign documents, and any of the consumers have eSigned, the system will add them to the wet sign package.

- After the redraw process is complete, the system will notify the settlement agent/notary if the wet sign package was updated.

- While documents are in the redraw process, the lender’s UI will look like the following screenshots:

Here is the settlement’s UI during the document redraw process:

If the consumer is accessing Snapdocs to review and eSigning the documents during the document redraw process, the system will inform them with the following message:

Here is the lender’s UI after the document redraw process has been completed:

Request document redraw from closing UI

The lender can also order a redraw from the closing UI. To do so, click Update documents > Add redraw documents:

Note:

- The existing closing must match the following requirements to receive the redrawn documents properly.

- Must match the GUID (if provided), file number, and consumer info sent in the redraw email.

- Closing must be in an open state (not closed or canceled).

- Closing must not have an appointment scheduled in the past.

- Closing must not have the signing appointment already marked as completed.