Learn how mortgage lenders are defending against margin compression

Watch our recent webinar to hear how industry leaders are utilizing technology to retain profit margins and delight borrowers.

Automate low-value tasks so your team can focus on revenue-generating activities

One workflow for all closings

Operate from the same workflow for any closing type - wet, hybrid, eNote, or RON - to eliminate all the back-and-forth

AI

AI-powered automation eliminates the most time-intensive & error-prone tasks

Automation

Comprehensive automated workflows reduce the repetitive tasks and decisions for your team

Settlement Network

Ensure success and adoption in the new purchase market by plugging into the largest, most engaged settlement network that conducts transactions successfully

Discover what the industry is saying about the recent shift in the mortgage industry

FINTECH SOLUTIONS

Maxwell's perspective on increasing mortgage processing efficiency

Read the Full ArticleMORTGAGE LENDER SENTIMENT SURVEY

Competition and Margin Compression in Lending

Read the Fannie Mae SurveyeClosings directly related to cost savings

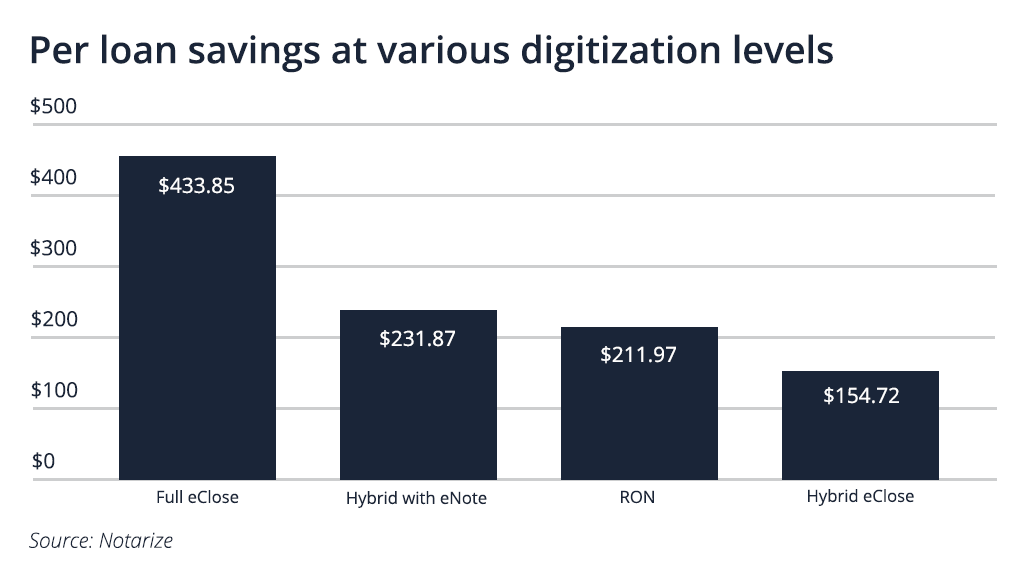

According to a recent study by Notarize, mortgage lenders can save $443.85 on their per loan costs if they do a full eClosing. These savings are crucial for an industry dealing with tighter margins, and Snapdocs can help make these cost savings a reality for your business.

Source: 2022 Notarize ROI Marketwise Study

See how Snapdocs’ customers have increased their operational efficiency

Jake Rowoldt | IS Project and Change Manager

"While working with Snapdocs, we've also seen a massive improvement in the borrower experience and our general operational efficiencies--including a reduction in cost of doing business. I highly recommend Snapdocs if you're looking to get ahead of the market, scale your digital closings, and improve borrower experience."

Vi Ryder | VP, Mortgage Operations

"We've seen quite a substantial rise in member satisfaction since using Snapdcos and we're going to be able to close more loans while spending less time and money actually doing so."

Lilly Matuatia | VP, Closing and Funding

"Compliance is also a huge expense at Evergreen, and for lenders in general. If you're running a mortgage operation, you're trying to figure out how you can do more with the same amount of staff, and how can you really leverage the technology to get more out of it. For that reason, we were able to see an ROI with Snapdcos almost immediately."